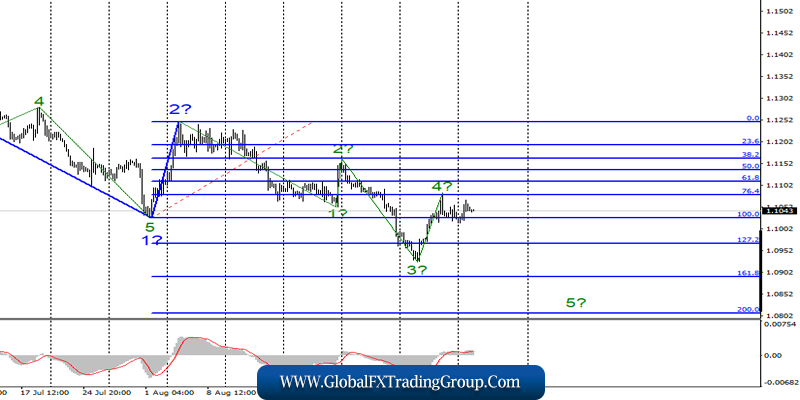

EUR / USD

Monday, September 9, ended for the EUR / USD pair with an increase of 20 basis points. However, the instrument did not go beyond the expected wave 4, thus, the current wave marking is not broken and still involves the construction of a bearish wave 5 with targets located below figure 9.

Going beyond the maximum of wave 4, in turn, will lead to the need to make adjustments to the current wave marking. Fundamental component: The instrument EUR / USD is now completely calm. The news background was absent on Monday, and will also be absent today and tomorrow.

Only on Thursday, when members of the ECB’s monetary committee will meet to discuss amendments to the current monetary policy of the European Union, it will be possible to count on the receipt of information that will affect the course of trading. Until Thursday, markets may remain in a half-sleeping state.

Despite that, I still look forward to building a bearish wave 5, which can be helped by a decrease in the interest rate by the European Central Bank, as well as any other measures that will be aimed at helping the economy of the European Union. Also, any speech by the ECB President Mario Draghi with the “dovish” color will cause additional demand for the American currency, and the euro will become cheaper.

Purchase goals:

1.1248 – 0.0% Fibonacci

Sales goals:

1.0893 – 161.8% Fibonacci

1.0807 – 200.0% Fibonacci

General conclusions and recommendations:

The euro-dollar pair continues to build the bearish wave 3 and supposedly completed the construction of the internal correctional wave 4 near the level of 1.1081. I recommend selling a pair with targets near the calculated levels of 1.0893 and 1.0807, which corresponds to 161.8% and 200.0% Fibonacci, on the new MACD signal “down” in the calculation of the construction of wave 5, 3.

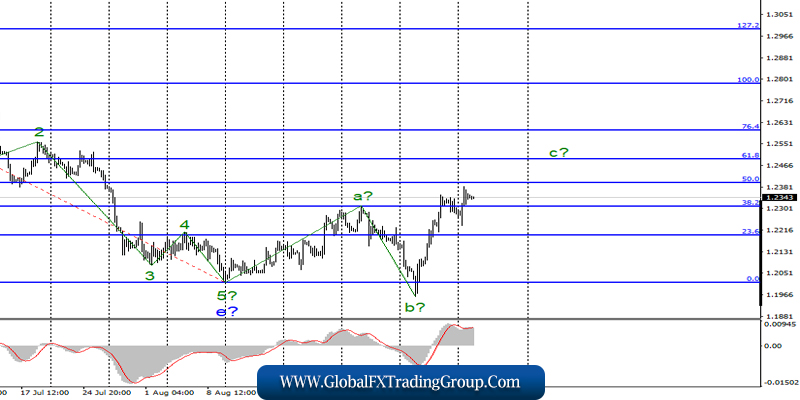

GBP / USD

On September 9, GBP / USD gained 60 base points thanks to fairly good economic reports from the UK. The change in GDP in July was higher than expected by the markets, + 0.3% m / m, and industrial production grew by 0.1%, although a value of -0.3% m / m was expected.

Thus, the pound-dollar continues to build the proposed wave with the composition of the correctional upward trend section, which originated on August 12. Despite the fact that wave b went beyond the minimum of wave 5, in e, the wave structure looks quite convincing. The only question is how long is the wave c?

And will the news background support its construction? Fundamental component: It’s no secret that the news background in the last 10 days has changed dramatically for the “Briton”. If two weeks ago the markets only considered the possibility of selling a pair of GBP / USD, as everything went to the implementation of the hard Brexit by Boris Johnson.

Now everything is going on the contrary, which is to Brexit’s postponement, that opens up additional opportunities for the British Parliament to prevent leaving the EU without a deal. As for the pressing economic components, all the major news of the day will come again from the UK.

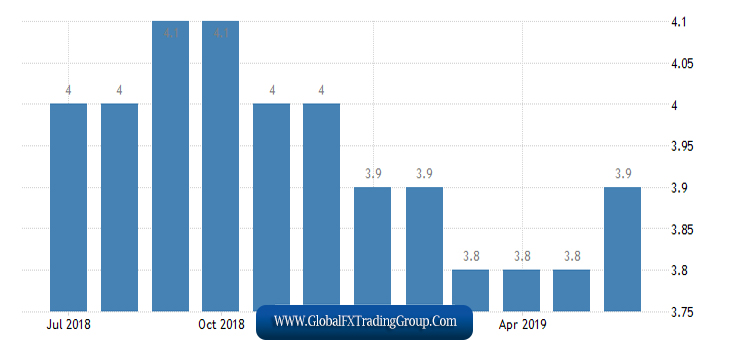

The most interesting data will concern the unemployment rate, which rose from 3.8% to 3.9% last month. Amid the confusion with Brexit, rising unemployment is quite normal.

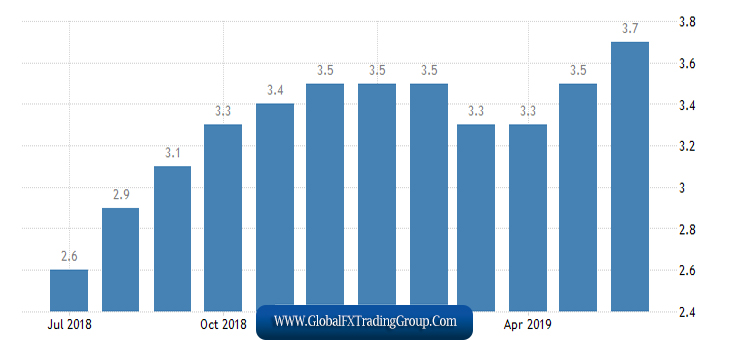

The second and more interesting news of the day is the changes in the level of wages in the United Kingdom of Great Britain and Northern Ireland in July. The expected value is + 3.7%, which does not differ from the June value. Thus, exceeding this forecast, as well as the forecast for the indicator of changes in wages excluding premiums (+ 3.8%), will be a favorable news background for the pound-dollar pair.

Sales goals:

1.2016 – 0.0% Fibonacci

Purchase goals:

1.2401 – 50.0% Fibonacci

1.2489 – 61.8% Fibonacci

General conclusions and recommendations:

The downward trend section is still considered completed. Thus, now, it is expected to continue the construction of the rising wave with targets located near the calculated levels of 1.2401 and 1.2489, which corresponds to 50.0% and 61.8% Fibonacci. You can now buy the pound, as the news background has changed for the “Briton”, but again in small lots, since the wave of c may end in the near future.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom