EUR / USD

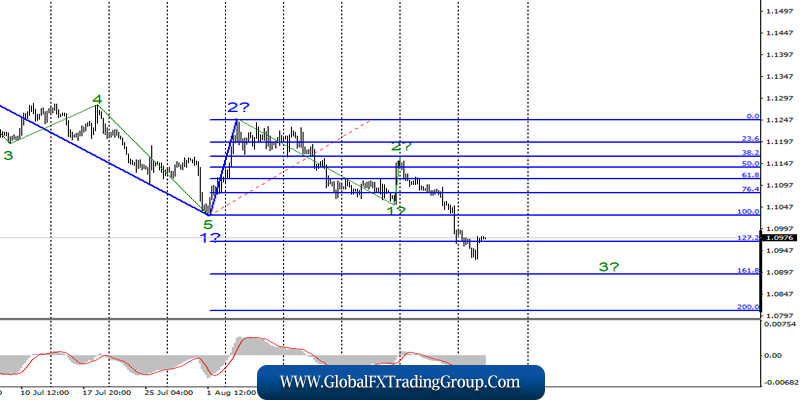

Tuesday, September 3, ended for the EUR / USD pair with an increase of 5 basis points, although the instrument went down by 40-50 bp during the day. Thus, there was reason to assume the beginning of building a correctional internal wave of 3, 3, or 4, 3 waves.

One way or another, quotes can now move away from previously reached minimums. On the other hand, the news background for the euro-dollar pair on Tuesday was unexpectedly positive. The American index of business activity in the ISM manufacturing sector fell below 50.0 and amounted to 49.1 in August.

Such a low value indicates a decline in the US industrial sector, the same as it is now fixed in the European Union. This news disappointed the markets very much and contributed to the appreciation of the euro.

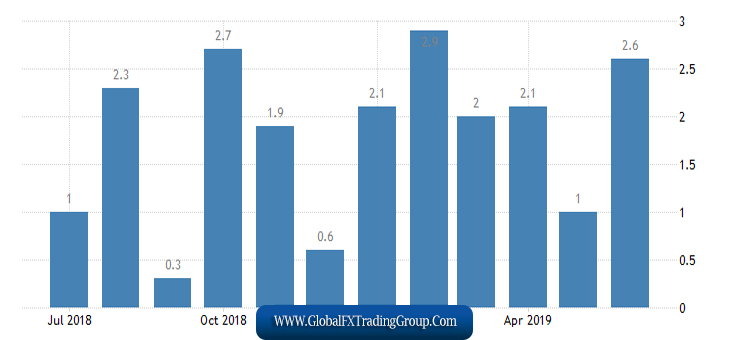

Today I draw attention to the index of business activity in the services sector of the European Union, from which, however, no one expects dramatic changes.

As well as the change in the volume of retail sales in the European Union in July, where it is expected to slow down to 2.0% y / y. There will be no important economic reports in the US today. Thus, if reports from the EU will not have real values much worse than the expectations of the market, the corrective upward wave will continue to build.

Purchase goals:

1.1248 – 0.0% Fibonacci

Sales goals:

1.0893 – 161.8% Fibonacci

1.0807 – 200.0% Fibonacci

General conclusions and recommendations:

The euro-dollar pair continues to build a bearish wave, which is now interpreted as 3, in 3. I recommend selling the pair with targets near the calculated levels of 1.0893 and 1.0807, which corresponds to 161.8% and 200.0% Fibonacci , MACD signal “down”.

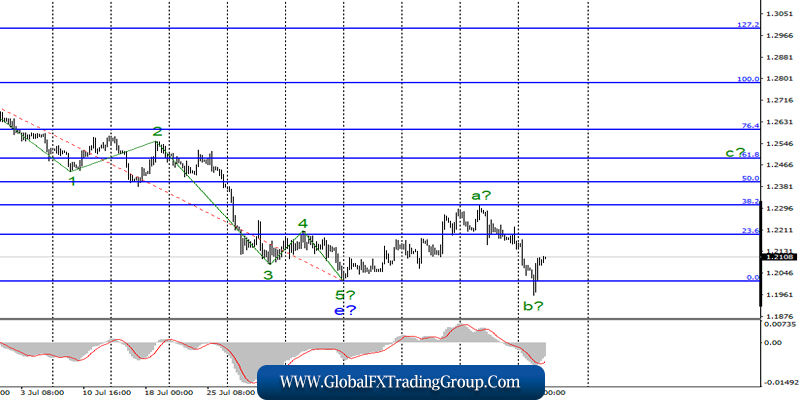

GBP / USD

On September 3, the GBP / USD pair gained about 15 basis points. Although during the day, as well as the euro, it fell much lower than the closing price of the day. Moreover, the pound-dollar pair managed to break through the minimum of the alleged wave e.

But now, this breakdown is interpreted as false, and the instrument retains the chances of building an upward wave with targets located above the 23 figure. The news background for the pound, in turn, unexpectedly changed to positive.

The first working session after the holidays took place in the British Parliament yesterday and it was decided to put to the vote the issue of the inadmissibility of Brexit without a deal with the European Union. In the near future, most likely today, the deputies will vote for this bill and it is likely to be adopted. It will be a huge “stick in the wheel” of Boris Johnson’s tough Brexit, who has already managed to threaten the deputies with new parliamentary elections if they interfere with his implementation of Brexit on October 31.

However, the forex market sees this as positive news for the pound, since the hard Brexit is clearly interpreted as a negative factor for the British currency. The further it is from sales, the better for the pound.

Today, I do not expect anything discouraging and unexpected from the index of business activity in the UK services sector. The forecast is 51.0 in August.

Sales goals:

1.2016 – 0.0% Fibonacci

Purchase goals:

1.2306 – 38.2% Fibonacci

1.2401 – 50.0% Fibonacci

General conclusions and recommendations:

The downward trend section is still considered completed. Thus, it is now expected to build an ascending wave with the first goals located near the calculated levels of 1.2306 and 1.2401, which corresponds to 38.2% and 50.0% Fibonacci. You can buy a pound, but I do not recommend doing it in large volumes.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom