EUR/USD

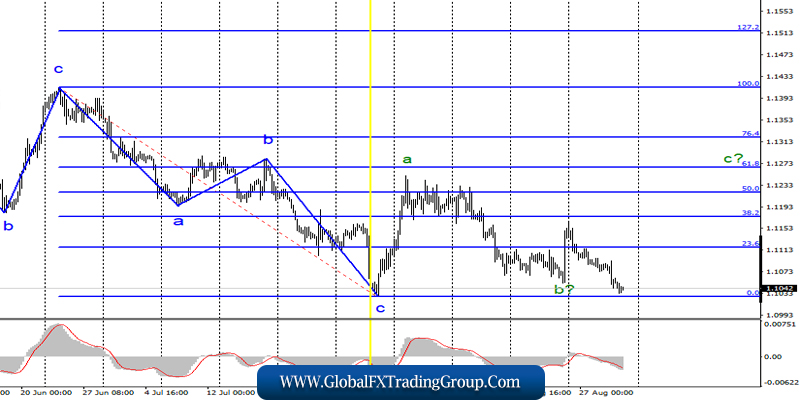

August started just fine for EUR/USD pair. For the first 5 trading days, the euro added about 200 base points, and that’s when there were serious expectations for the construction of an upward trend segment, so strong and sharp was the growth of the instrument.

However, after August 5, the euro wasn’t something that could not grow, the flat started first, then a slow descent, after which it collapsed to the lows of the month, year and two-year period. Now, on August 30, the pair is near the lows of the expected wave C and threatens to disrupt the current wave layout, which still involves the construction of an upward wave that will be the final one in the three-wave correction structure.

However, the news background harms the euro, which does not allow this currency to build an upward wave. If the ECB lowers the rate in September and announces a restart of the stimulus program, it could further hit the positions of the euro. The current wave marking is more suited to the new Fed rate cut. In conclusion, I recommend that you still count on building a wave from as long as the instrument is not out of the minimum of August 1.

Purchase targets:

1.1264 – 61.8% according to Fibonacci

1.1322 – 76.4% according to Fibonacci

Sale targets:

1.1027 – 0.0% according to Fibonacci

General conclusions and recommendations:

The euro/dollar pair continues to be in the framework of building a downward wave, presumably b. I recommend buying a pair with targets located above the mark of 1.1250 with a stop-loss order under the low of August 1 on the MACD signal “up”. I recommend selling the instrument not earlier than a successful attempt to break the minimum of wave C, but even in this case, I recommend to act very carefully.

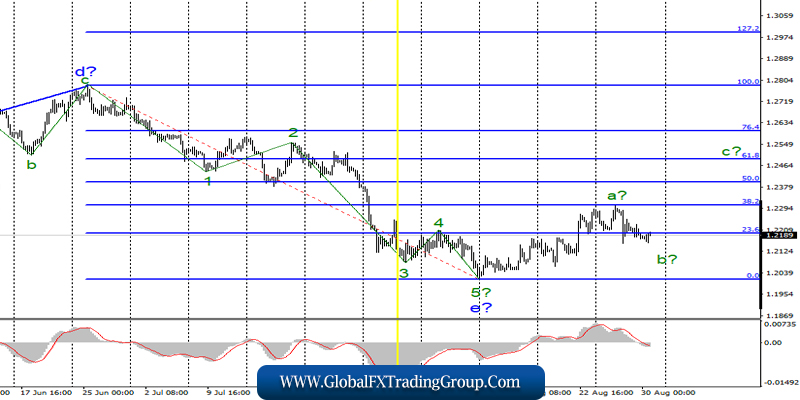

GBP/USD

The GBP/USD pair for August even managed to add a few dozen points, despite the negative news background. The news background, which is unfavorable for the pound, remains, but the current wave marking suggests the construction of an upward trend section, therefore there are serious contradictions between the news and the waves.

Until September 3, trading in the pair will be paused, as markets will look forward to concrete action from the parliament, which will have to decide in one week how to block the decision of Boris Johnson to suspend parliament for 5 weeks. Until this issue is resolved, the probability of a hard Brexit remains very high, and this could play a cruel trick on the pound in the form of a fall to the 20th figure and below, despite the current wave marking.

At a later period, there is no sense to predict anything now, because everything will be decided, most likely, between September 3 and 9. On September 9, the Parliament will leave by the decision of the Prime Minister for compulsory leave for another 5 weeks.

Sale targets:

1.2016 – 0.0% according to Fibonacci

Purchase targets:

1.2306 – 38.2% according to Fibonacci

1.2401 – 50.0% according to Fibonacci

General conclusions and recommendations:

The downward section of the trend is previously considered completed. Thus, the anticipated creation of the upward correctional channel with the first order placed near the settlement marks of 1.2306 and 1.2401, which corresponds to 38.2% and 50.0% of Fibonacci. You can buy the pound in the current conditions, but I do not recommend doing it in large volumes, firstly, and secondly, it should be done after the completion of the current corrective wave down, on the MACD signal “up”. In the period between September 3 and 9, traders need special care and caution.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom