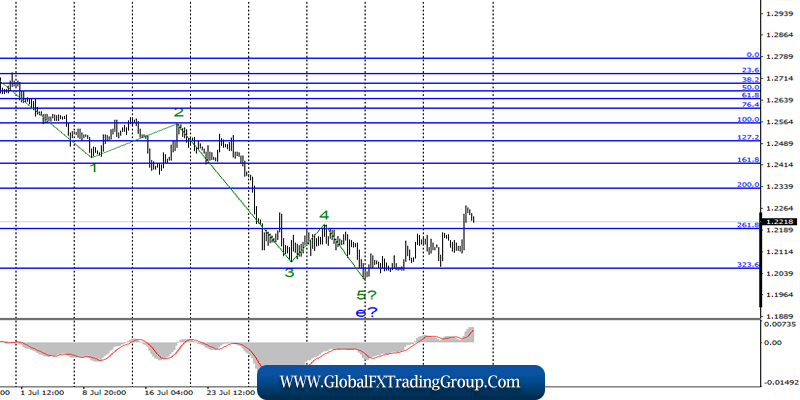

EUR / USD

Thursday, August 22, ended for the EUR / USD pair with a decrease of only a few base points. Yesterday, there was no news from Europe and America, so the market activity was not great. The wave marking remains unchanged, but the euro-dollar instrument is still inclined to a new fall, despite the expected construction of an upward wave c.

However, I have already said that the news background can greatly affect the movement of the pair, up to the extent that wave marking will require adjustments. Today, markets will follow Fed Chairman Jerome Powell’s speech at a symposium in Jackson Hole. The chance of the eurocurrency building a wave with is only in the “dovish” comments of the head of the Fed.

If Jerome Powell informs that the Fed intends to continue cutting rates, this will be regarded by the market as negative information, and demand for the US dollar may decline. Otherwise, the pair can make a successful attempt at breaking the minimum of August 1 today.

Purchase goals:

1.1264 – 61.8% Fibonacci

1.1322 – 76.4% Fibonacci

Sales goals:

1.1027 – 0.0% Fibonacci

General conclusions and trading recommendations:

The euro-dollar pair has been trying for several days in a row to complete the construction of wave b. Given the proximity to the minimum of wave c, now is a good time to buy an instrument in the calculation of building a wave c with targets located above the level of 1.1250. I recommend placing restrictive orders under the minimum of August 1. However, a successful attempt to break through the 0.0% Fibonacci level will indicate that the market is ready to build a new downward wave.

GBP / USD

On August 22, the pair GBP / USD gained 130 basis points, which is almost out of the blue. Markets reacted to Angela Merkel’s words that London and Brussels could still get out of the crisis and find a solution to a “back-stop” on the border between Ireland and Northern Ireland.

Generally, this does not mean that the parties will be able to find a solution, given the fact that they could not find it for a much longer period of time than 2 months. And, for example, French President Emmanuel Macron, with whom Boris Johnson also had a meeting, was more categorical than Merkel, and said that there would be no cancellation of the back-up mechanism.

Johnson himself said that Britain would not allow the appearance of a physical border, customs, and inspections between Ireland and Northern Ireland. However, a wave of optimism still swept the markets, and the pound soared upwards.

Question, how long will the pound strengthen? Based on the wave markings, I expect the construction of three corrective waves, at least, but this does not mean that the pound will be able to increase in price too much. It is possible that about 23 and 24 figures growth will end, given the negative news background for the UK currency.

Sales goals:

1.2056 – 323.6% Fibonacci

1.1830 – 423.6% Fibonacci

Purchase goals:

1.2334 – 200.0% Fibonacci

General conclusions and trading recommendations:

The downward section of the trend is previously considered completed. Thus, it is now expected to build an upward trend correction section with the first goals located near the calculated level of 1.2334, which corresponds to 200.0% Fibonacci. I recommend to wait until the completion of the construction of the rising set of waves and then sell the pound sterling again, since the news background does not yet imply strong purchases of the pair pound-dollar.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom