EUR / USD

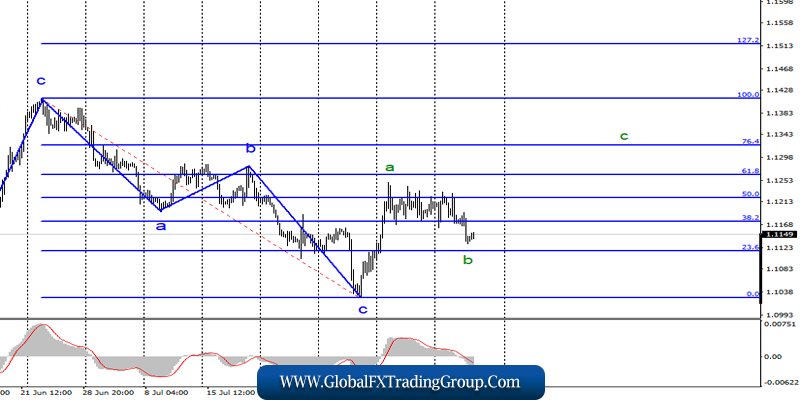

Wednesday, August 14, ended for the EUR / USD pair with a decrease of 30 bp. Thus, the estimated wave b of the upward trend section takes on a more complex form, but the current wave marking does not change. Based on the wave pattern, the euro-dollar instrument is still expected to increase with targets located above the 13th figure.

However, as mentioned earlier against the euro and the pound, the news background is now working. For example, yesterday, industrial production in the European Union collapsed by 2.6% y / y. Today, markets will wait for the publication of a report on retail sales in America and if the forecast of + 0.3% m / m is exceeded, then we can expect an even greater decline in the pair and the complication of wave b.

The most interesting thing is that the constant feeding of a pair with a negative news background can calmly lead to a drop in quotations to a minimum of wave c, which will complicate the entire wave pattern and continue the construction of the downward trend section. It is the news that is now of paramount importance for EUR / USD.

Purchase goals:

1.1264 – 61.8% Fibonacci

1.1322 – 76.4% Fibonacci

Sales goals:

1.1027 – 0.0% Fibonacci

General conclusions and trading recommendations:

The euro-dollar pair continues to build the upward trend section. Thus, I recommend buying a pair with targets near the calculated levels of 1.1264 and 1.1322, which is equal to 61.8% and 76.4% according to Fibonacci signal, and according to the MACD signal upwards, counting on the construction of the ascending wave s.

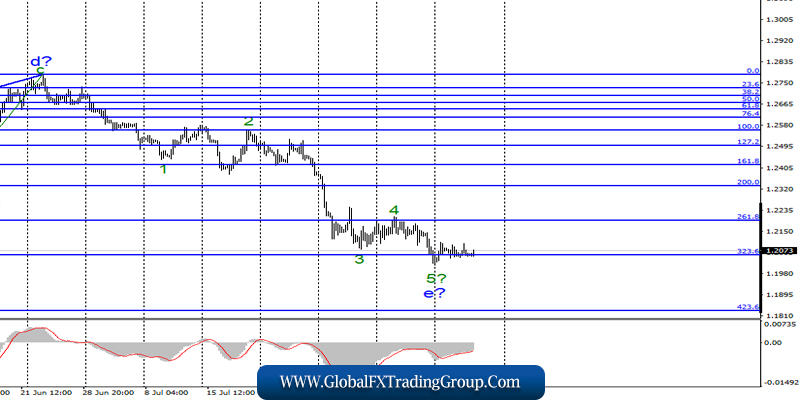

GBP / USD

On August 14, the GBP / USD pair is trading near multi-year lows, while maintaining high chances of further complicating the downward trend section. The inflation report published in the UK yesterday did not trigger demand for the pound sterling, although it turned out to be higher than the forex market expected.

Today, the foreign exchange market is waiting for data on retail sales in the United States and Britain, and expectations of a slowdown in the Foggy Albion. However, the main theme for the pair pound-dollar remains to be the Brexit. And although there are no recent and interesting messages on this topic, the market is waiting for them.

But it is unlikely that anything positive will be expected, since there are no prerequisites for improving the situation. The country is rapidly moving towards Brexit without a deal, which will have a detrimental effect on the economy of the United Kingdom. Nevertheless, Boris Johnson refuses to consider options other than hard.

Sales goals:

1.2056 – 323.6% Fibonacci

1.1830 – 423.6% Fibonacci

Purchase goals:

1.2783 – 0.0% Fibonacci

General conclusions and trading recommendations:

The downward section of the trend became more complicated, and the pound-dollar pair made a successful attempt to break through the 323.6% Fibonacci level. Despite the fact that the wave e looks complete, it can take an even more complex form. Thus, with the new MACD signal down, I recommend selling a pair with targets near the level of 1.1830, which corresponds to 423.6% Fibonacci.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom