EUR / USD

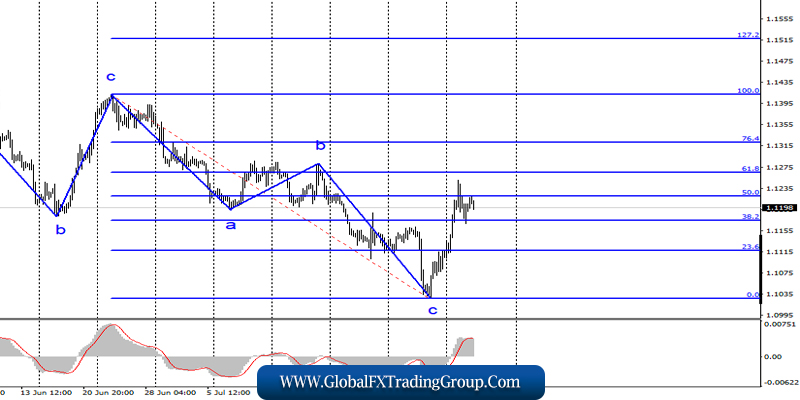

Tuesday, August 6, ended for the EUR / USD pair with the loss of several base points. The deviation of quotations from the reached highs suggests the completion of the first wave of a new upward trend section. If this is true, then the decline in quotations of the euro-dollar pair will continue.

Yesterday, the euro stopped being in demand from the markets, as continuous growth lasted 4 days. The time has come for the correctional wave but there is no news background for the instrument now. The markets have already digested all the information about a possible reduction in ECB rates, about a Fed rate cut, about a trade war between Trump and China and are now waiting for new data.

The euro, therefore, will need news support in order to continue the increase. However, serious problems can arise with this. It is not a secret that often corrective counter-trend waves are an acceleration of the instrument before a new fall, and now, given the general news background, which remains not in favor of the euro, it is difficult to assume the construction of a stronger trend section than the 3-wave one. Moreover, it is also difficult to imagine the euro currency above 13-14 figures.

Purchase goals:

1.1264 – 61.8% Fibonacci

1.1322 – 76.4% Fibonacci

Sales goals:

1.1027 – 0.0% Fibonacci

General conclusions and trading recommendations:

The euro-dollar pair has moved to the construction of an upward trend section. Thus, I recommend buying a pair with targets near the levels of 1.1264 and 1.1322, which equates to 61.8% and 76.4% Fibonacci, for each MACD upward signal, based on the construction of three upward waves.

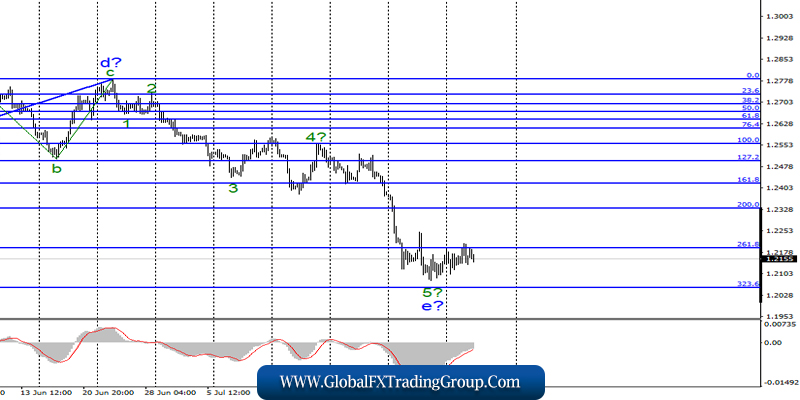

GBP / USD

On August 6, the GBP / USD pair gained about 25 base points. However, the wave pattern of the last days looks as if the participants of the vacation market. The pound-dollar pair recovered to the level of 261.8% Fibonacci, but if the market is on vacation, then the bulls have a long vacation.

The pound has still no support and is not in demand even in the short term. The news background for the instrument, as before, is not in favor of the British pound. Yesterday, the European Commission said that it sees no reason to continue negotiations on an agreement on Brexit. Thus, the more I do not understand.

On the basis of which Boris Johnson believes that the EU should make concessions on the issue of back-stop? And the British Minister, for the preparation for tough Brexit, Michael Gove, accused the European Union of not wanting to enter into new negotiations. In this way, the parties are now at different poles of the planet and are trying to shout to each other.

Moreover, it is really not clear what Boris Johnson is guided by when he first declares that he is going to hold new negotiations with the EU publicly, and then accuses the EU of unwillingness to enter into these negotiations?

Sales goals:

1.2056 – 323.6% Fibonacci

1.1830 – 423.6% Fibonacci

Purchase goals:

1.2783 – 0.0% Fibonacci

General conclusions and trading recommendations:

The wave picture of the pound-dollar instrument suggests the continuation of the construction of the downward trend section. Thus, I recommend selling the pair on the new MACD signal down with targets located near the calculated levels of 1.2056 and in the case of a successful attempt at a breakthrough – with targets located about 1.1830, which corresponds to 423.6% Fibonacci.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom