EUR / USD

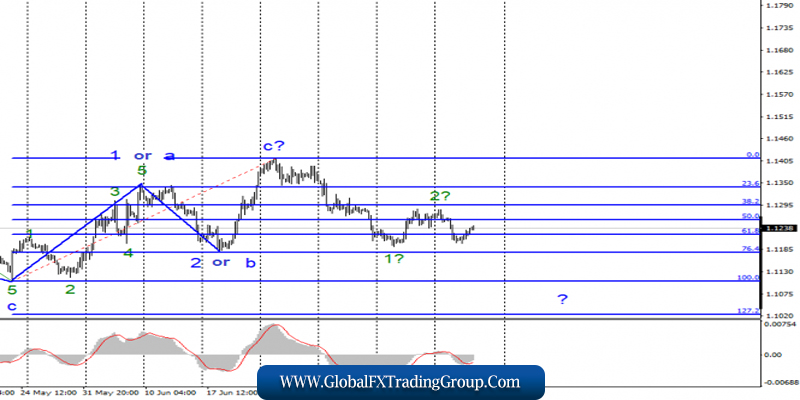

On Wednesday, July 17, trading ended for EUR / USD with a 15 bp increase. It can be assumed that the pair nevertheless, proceeded to build a new downward trend.

However, before breaking the minimum of the expected wave 1 or wave 2 or b, it is not time to talk about the readiness of the foreign exchange market for further sales. The fact is that the markets are not sure that further sales of the instrument are expedient in the light of a possible and very likely reduction in the Fed rate.

At the same time, there are no reasons to buy Eurocurrency from the markets either. Therefore, it can be noted that the waiting period has come. There is a mutual closing of positions on both sides, which leads to averaging of prices.

Yesterday’s report on inflation in the European Union can be interpreted in different ways. On one hand, it slightly exceeded market expectations, and meanwhile, inflation remains at a very low level, which can make the European Central Bank not only lower the rate, but also re-launch a program to stimulate the economy and the banking system. All this will be regarded as a weakness of monetary policy.

Purchase goals:

1.1412 – 0.0% Fibonacci

Sales targets:

1.1106 – 100.0% Fibonacci

1.1025 – 127.2% Fibonacci

General conclusions and trading recommendations:

The euro / dollar pair still holds hopes for the upward trend. I still recommend small purchases of euros with targets located near the estimated mark of 1.1412, which equals to 0.0% Fibonacci, and an order restricting possible losses, under a minimum of wave 2 or b. Leaving the tool below the mark of 1.1179 will indicate that the tool is ready to build a downward trend.

GBP / USD

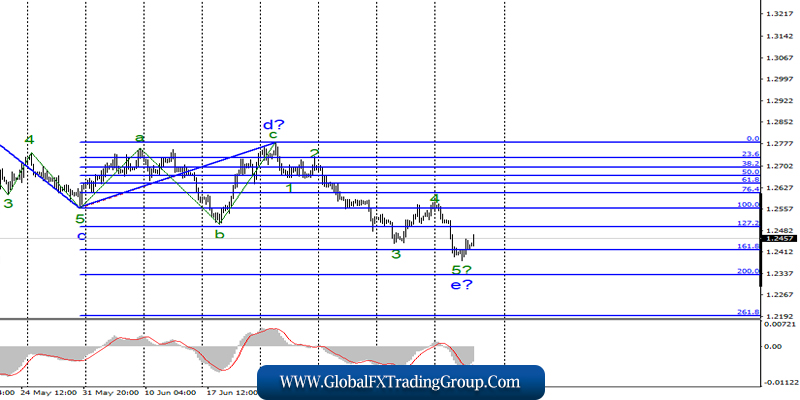

The GBP / USD pair rose on July 17 by 30 basis points, and the current wave counting assumes the completion of the construction of the downward trend section, in particular, its fifth wave e.

If this is true, then from the current position, the quotation increase will continue with targets located about 28 figures and above. Everything will depend on whether a 3-wave corrective part of the trend will be built or a full-fledged impulse.

Despite the expected completion of the downside, this does not mean that now the pound will breathe freely, as the news background remains extremely unfavorable for this currency.

Thus, in the best case, the news will allow the pound-dollar tool to build up three waves, which can be quite weak, at worst, the e waves or the entire downward trend section will become more complicated, which can be identified by the breakthrough of the current minimum of the e wave.

Sales targets:

1.2334 – 200.0% Fibonacci

1.2194 – 261.8% Fibonacci

Purchase goals:

1.2783 – 0.0% Fibonacci

General conclusions and trading recommendations:

The wave pattern of the pound / dollar instrument assumes the completion of the construction of the downward wave e. Thus, I recommend small purchases of a pair with targets located around 28 figures and with an order restricting losses under the minimum of wave e. I do not recommend to return to sales yet.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom