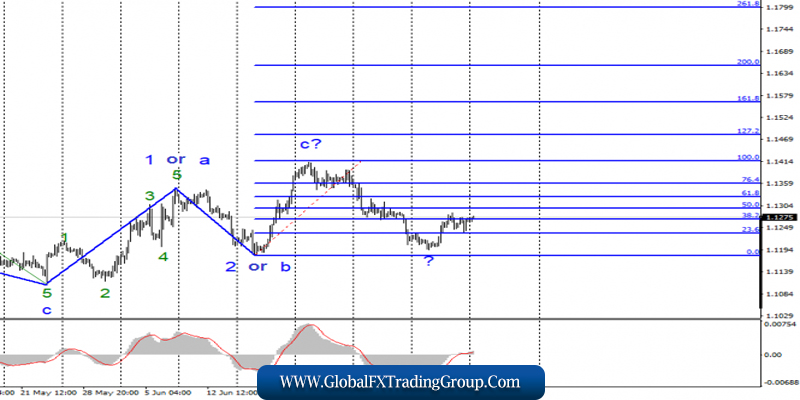

EUR / USD

On Friday, July 12, trading ended for EUR / USD by another 20 bp increase. Thus, the departure from the previously reached lows around the level of 0.0% Fibonacci continues.

And at the same time, it remains unclear whether the construction of the upward section of the trend, taking its beginning on May 23, has been completed or will it still take the 5th wave form (or, at least, will the wave become more complicated)?

The news background on Friday was very weak and did not help either the dollar or the euro. Today, the situation in this regard does not change at all, since news and reports are not expected. But tomorrow there will be another speech by Jerome Powell, Fed Chairman.

And although he is unlikely to be able to surprise the markets with anything, an event of this magnitude should not be missed. Because new hints on the Fed’s readiness to ease monetary policy may again trigger euro purchases and dollar sales.

This is exactly what is needed for the current wave marking, which still implies the construction of an upward trend.

Purchase goals:

1.1417 – 100.0% Fibonacci

1.1480 – 127.2% Fibonacci

Sales targets:

1.1180 – 0.0% Fibonacci

General conclusions and trading recommendations:

A pair of euro / dollar presumably remains in the upward trend. I recommend to buy euros with targets located near the estimated marks of 1.1417 and 1.1480, which equates to 100.0% and 127.2% of Fibonacci, and an order restricting possible losses, under the minimum of wave 2 or b. Leaving the tool below the 0.0% level will require making adjustments to the current markup.

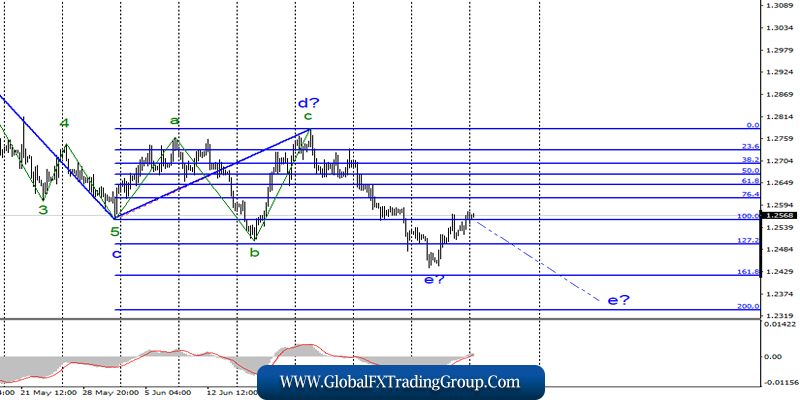

GBP / USD

The pair GBP / USD rose on July 12 by 50 basis points and continues to move away from local minima. However, the estimated wave e still does not look fully manned, which suggests a resumption of the decline of the pound sterling in the coming days.

Support for this option may be found in the news background, which with enviable stability is not in favor of the British currency. There are no positive shifts in the Brexit process, and the country continues to choose a new prime minister.

Jeremy Hunt fears new parliamentary elections, and London managed to get into a scandal with Donald Trump, as the British ambassador to the US got in touch where he was unflattering about the president of the USA.

Trump has already hinted that this incident could have serious consequences for the relationship between Washington and London.

Sales targets:

1.2418 – 161.8% Fibonacci

1.2334 – 200.0% Fibonacci

Purchase goals:

1.2783 – 0.0% Fibonacci

General conclusions and trading recommendations:

The wave pattern of the pound / dollar instrument involves the construction of a downward wave e. Thus, I recommend selling the pair with targets located near the estimated marks of 1.2418 and 1.2334, which corresponds to 161.8% and 200.0% in Fibonacci, when the MACD signal is down.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom