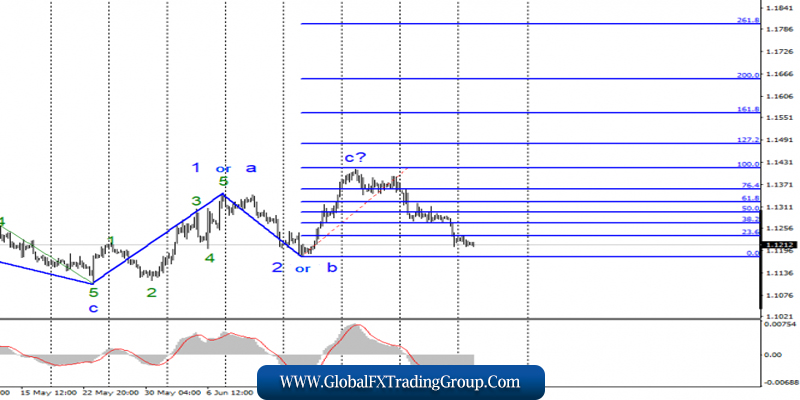

EUR / USD

Monday, July 8, ended for the pair EUR / USD by another 10 bp decline. In general, Monday was held in inactive trading, as there was not a single factor capable of forcing traders to trade more actively.

Today, this factor will be only one – this is the speech in the Congress of Fed Chairman Jerome Powell. However, no one yet knows what exactly Powell will talk about and how far his speech will be interpreted as “dovish” or “hawkish”.

But after all, the reaction of the foreign exchange market in all pairs where the US dollar is present depends on this. Unfortunately, for the euro currency, the markets are buying the US currency again and in just a few dozen points I will have to state that the instrument has moved to constructing a new downward trend, since at least the expected wave 2 or b can be passed.

Then, after May 23, the entire upward set of waves will be treated as three waves. The news background begins to be in favor of the US currency again.

Purchase goals:

1.1417 – 100.0% Fibonacci

1.1480 – 127.2% Fibonacci

Sales targets:

1.1180 – 0.0% Fibonacci

General conclusions and trading recommendations:

The euro / dollar pair is expected to remain in the upward trend. I recommend buying euros with targets located near the estimated levels of 1.1417 and 1.1480, which equates to 100.0% and 127.2% Fibonacci, if the pair does not go below the level of 0.0%. However, leaving the instrument below the level of 0.0% will require adjustments to the current markup.

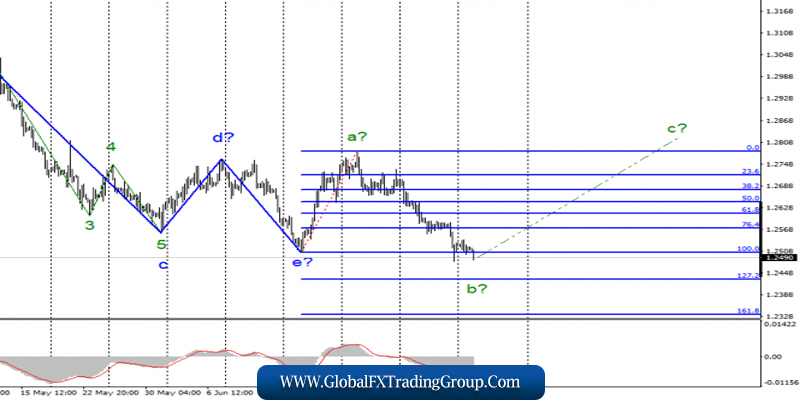

GBP / USD

The GBP / USD pair has lost only a few base points on Monday and broke through the low of the e-wave for the second time. Thus, as I said yesterday, in the best case for the pound sterling, the pound-dollar instrument moves to a horizontal trend segment.

If the attempt to break the level of 1.2503 turns out to be unsuccessful (and the probability of this is extremely low), then the pair will still have chances to build an upward wave from. However, a successful attempt of a breakthrough will lead to the fact that the instrument will proceed to the construction of a new downward trend.

News background is unlikely to save the drowning pound sterling. Today, there will be a speech by Powell, which theoretically could cause the US dollar sales, but even in this case, it is difficult to count on a strong increase in the instrument.

Thus, I expect a decline to the levels of 127.2% and 161.8% Fibonacci, if the attempt to break the level of 100.0% will be successful.

Sales targets:

1.2431 – 127.2% Fibonacci

1.2334 – 161.8% Fibonacci

Purchase goals:

1.2783 – 0.0% Fibonacci

General conclusions and trading recommendations:

The wave pattern of the pound / dollar instrument involves the construction of an upward wave c, but only in the case of an unsuccessful attempt to break through the 100.0% Fibonacci level.

Thus, I recommend extremely small purchases of a pair with targets located about 28 figures and an order limiting losses under the level of 100.0%.

The breakthrough of the 1.2506 level will translate the instrument into the status of building a trend’s downward trend with targets located near the levels of 1.2431 and 1.2334.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom