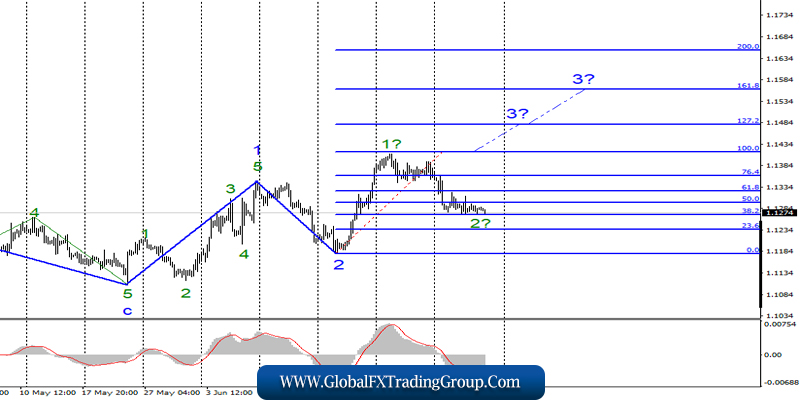

EUR / USD

On Thursday, July 4, trading ended with an increase of 5 basis points for the EUR / USD pair. Over the past three days, the wave pattern did not only changed. The instrument also remained in one place.

By yesterday, there are no questions. The low activity of the foreign exchange market was due to a holiday in the US. However, today’s Friday, July 5, and the situation has not much changed. The Fibonacci level of 38.2% continues to keep the euro-dollar from further decline.

However, it seems that the point is not the strength of this level, but the lack of desire among bears to sell the euro. Today, however, such a desire may reappear, since in America, data on unemployment and wages for June is planned to be released in the labor market. This is considered as an important data for the US economy and, therefore, the US currency.

In this way, the main question for today is whether the US statistics will show positive changes. If so, then the dollar will grow even stronger, and the construction of the upward trend section will be questioned, since wave 2 to 3 is already quite strong and extended.

Purchase goals:

1.1417 – 100.0% Fibonacci

1.1480 – 127.2% Fibonacci

Sales targets:

1.1180 – 0.0% Fibonacci

General conclusions and trading recommendations:

The euro / dollar pair is presumably located within the 3 waves of the upward trend. I recommend buying the euro with targets located near the estimated marks of 1.1417 and 1.1480, which equates to 100.0% and 127.2% Fibonacci, when the MACD signal is up. However, leaving the tool below 38.2% will overlap the current recommendation.

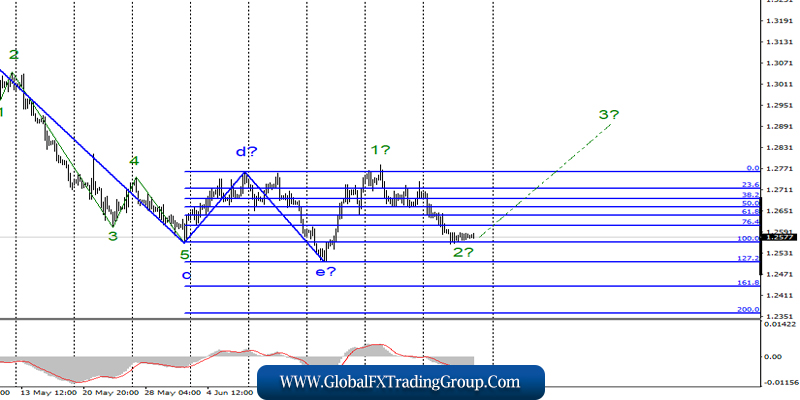

GBP / USD

The GBP / USD currency pair scored a few basis points yesterday, which is clearly not enough to make corrections or adjustments to the current wave marking. In the case of the pound-dollar pair, everything is about the same as for the euro-dollar pair.

The instrument fell to the level of 100.0%, which keeps traders from new sales. However, the news that will be released today in America might bring back the desire of traders to buy a dollar.

In any case, it will lead to an increase in the activity of the Forex market, which in the last two or three days has clearly slept. The question is whether the news will contribute to further dollar growth, or will they disappoint traders?

The euro and pound will rise in price, which will fully correspond to the current wave counting, which implies an upward wave 3.

Sales targets:

1.2434 – 161.8% Fibonacci

1.2359 – 200.0% Fibonacci

Purchase goals:

1.2767 – 0.0% Fibonacci

General conclusions and trading recommendations:

The wave pattern of the instrument for the pound / dollar pair involves the construction of a new upward trend. At the same time, I recommend waiting for a successful attempt to break through the maximum of wave d, which confirms the willingness of markets to further increase, and only after that, purchases will be made.

The MACD signal “up” allows you to open small purchases with targets that are near the 1.2750 mark and a Stop Loss order under the minimum of wave e.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom