Over the past day, the situation for the euro has hardly changed — the price is exactly where it was yesterday morning. However, the tension and anxiety around the euro have intensified. Yesterday’s data on economic sentiment turned out to be in favor of Europe and the euro: the eurozone composite PMI for September rose from 51.0 to 51.2, while in the U.S. the composite PMI weakened from 54.6 to 53.6. But the tension came from elsewhere: Fed representatives Bostic, Bowman, and Powell stated that further monetary easing is possible only in the event of a significant deterioration in the economy.

Powell directly mentioned an overvaluation of the stock market, while representatives of the real sector expressed doubts about the infrastructure’s ability to sustain the unrestrained plans for AI development. Altogether, the Nasdaq fell by 0.95%, and the S&P 500 by 0.55%. The euro rose only symbolically, but the trading volume yesterday exceeded Monday’s volume (the increase was 58 points), which indicates closing of long positions. Now, if the stock market continues to decline (which we expect), the euro will follow it in crisis correlation.

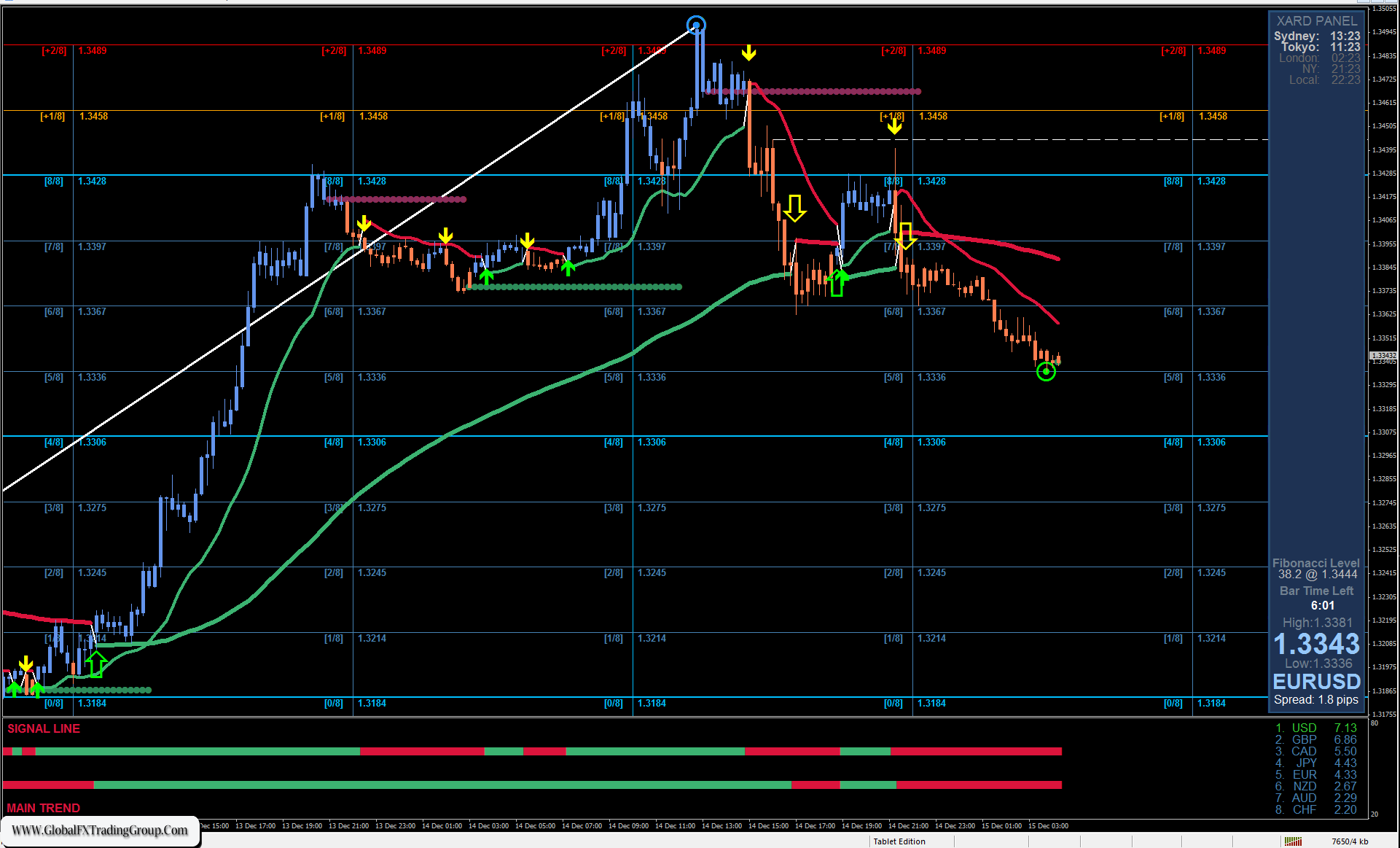

On the daily EUR/USD chart, the Marlin oscillator is turning downward. A break below yesterday’s low will signal a looming attack on the MACD line at 1.1720. A breakout of this level opens the target at 1.1605. The likelihood of growth toward 1.1916 has fallen significantly.

On the four-hour chart, the price is preparing to break below the MACD line (1.1791). If this intention is realized, the Marlin oscillator will automatically move into the bearish zone, and the 1.1720 target will soon be reached.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 28 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom