The euro is holding above support at 1.1632 for now, as the Jackson Hole symposium begins today and investors are focused on the December rate decision, with the probability of a cut currently at 45.5%.

However, according to the Federal Reserve itself (as reflected in the “minutes” published yesterday), the central bank has not yet made up its mind on this issue. The previously expected two cuts were almost immediately called into question due to rising inflation.

We consider it likely that Powell will present the Fed’s stance in a cautious tone, following a strategy of “cut in September and see the effect.” But we see the key issue elsewhere: during the groundless verbal campaign of “sell America,” which in practice turned only into “sell the dollar,” the euro gained 15 figures.

Empirically, this already factors in three Fed rate cuts, meaning markets could easily correct two-thirds of this growth (toward 1.0850), even after two actual cuts, once the new narrative of “buy the dollar” takes hold. And that backdrop may emerge very soon—in fact, it is already beginning to take shape.

The fading AI hype is the reason: Nvidia’s stock has hardly risen throughout August. U.S. government bond yields have been declining since mid-May, which suggests a gradual market shift away from risk. Even Bitcoin has been moving sideways for six weeks, and in the past week, it has started to decline. Thus, after a break below support at 1.1632, we expect the euro to move toward the first target of 1.1495.

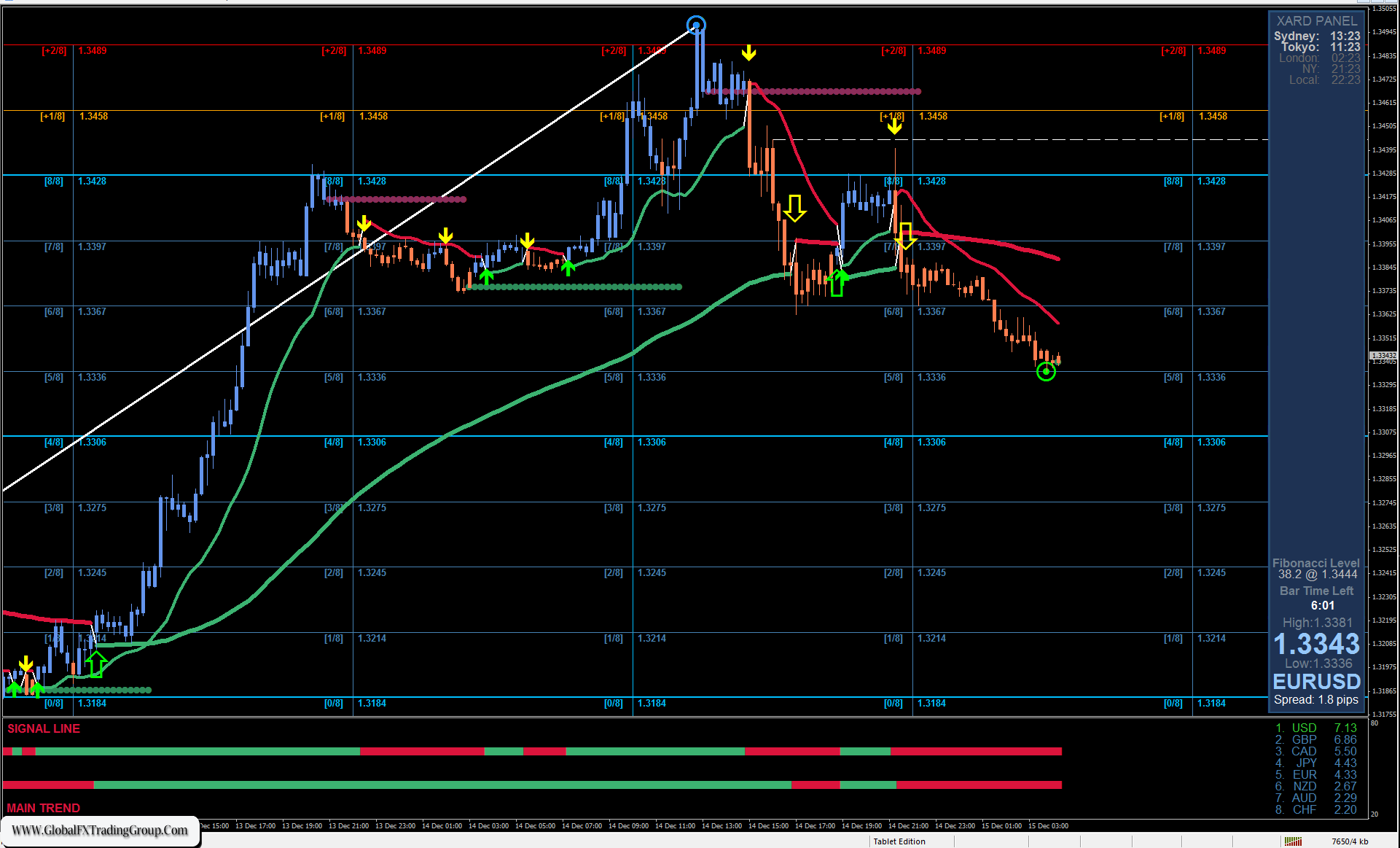

On the H4 chart, the picture also remains calm. The MACD line decisively stopped yesterday’s attempt at price growth. The Marlin oscillator briefly entered positive territory but quickly returned. The market remains in a wait-and-see mode.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 28 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom