Following yesterday’s FOMC meeting, the current rate was left unchanged, and the markets received a clear signal — the rate may also remain unchanged at the September meeting. Now, markets expect only one rate cut by the end of the year, as previously hinted at before the “blackout period.” The cut has simply been “moved” from September to December.

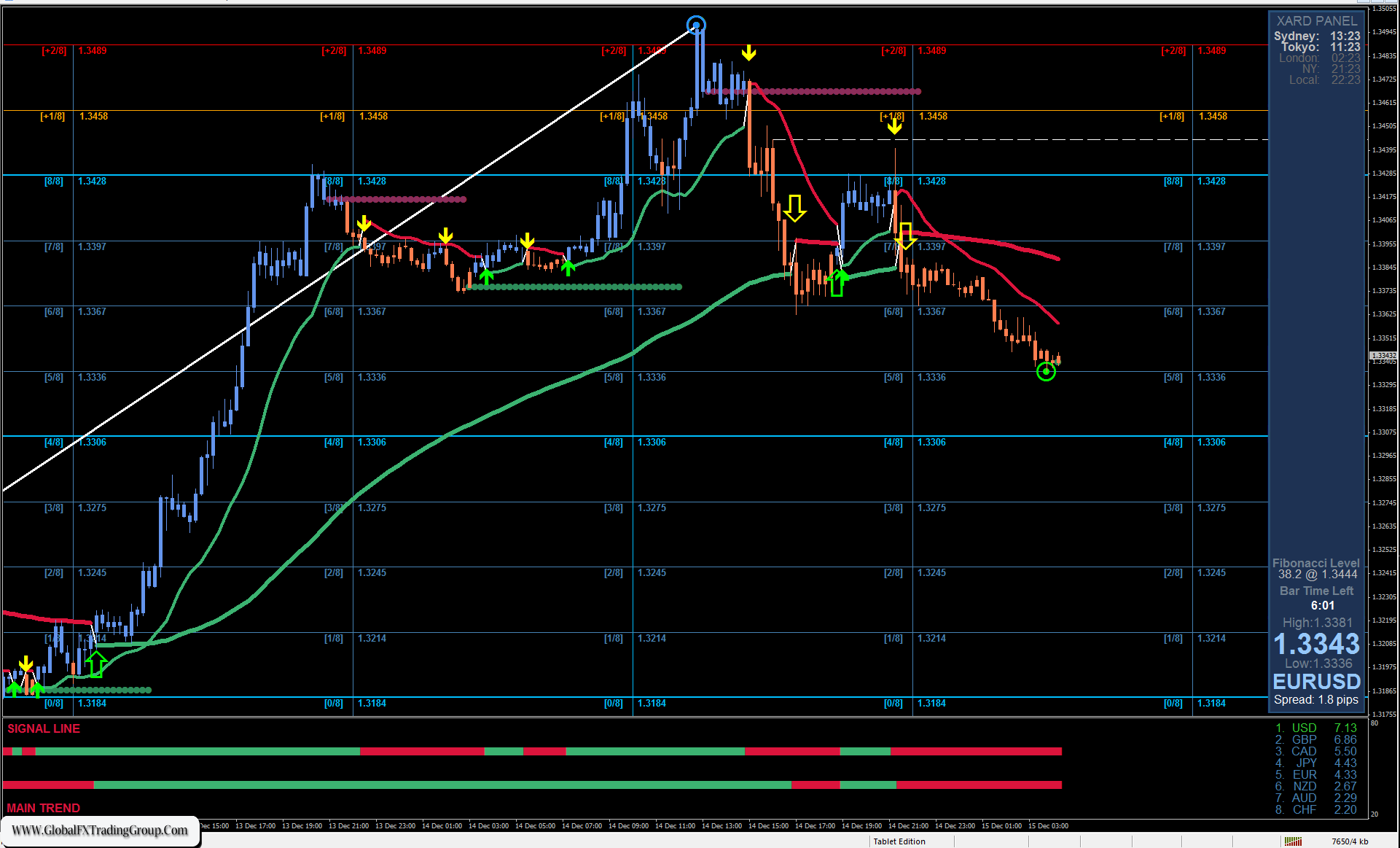

The EUR/USD pair is just “half a step” away from the target support, and consolidation below it would open the way toward 1.1266. However, the 1.1380 target might have been misidentified, and the price could now move into a correction from yesterday’s low of 1.1401. In any case, the price is within the June 3–11 consolidation range, and a breakout above 1.1495 could set an alternative scenario in motion.

The reason for this lies in the resilience of the stock market — S&P 500 futures have reversed upward and are already close to their historical highs as of July 28. On Friday, Nonfarm Payrolls for July are forecast at 108,000, compared to 147,000 in June. A weak report could reverse the stock market, but weekly jobless claims remain optimistic. Therefore, anticipation of the labor market data is a valid reason for the euro to move sideways within the 1.1380–1.1495 range.

On the H4 chart, the euro has sufficient room to consolidate below 1.1380. There is logic in this move — to demonstrate resolve (or readiness) to meet moderately positive U.S. employment data. If the price moves toward the upper boundary of the range, it would be a more subtle preparation for a dollar-positive scenario — i.e., unloading the Marlin oscillator before a continuation of the decline. Such a correction would also be beneficial for the daily Marlin oscillator.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 28 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom