The main event of yesterday largely aligned with our forecasts — specifically, the anticipated “number play” occurred. But it was done very delicately, just enough to halt the growth of anti-dollar currencies. Reuters’ initial Nonfarm Payrolls forecast was 120,000, but on the day of the release, it was revised down to 111,000, making the published figure of 147,000 new jobs appear more significant.

The May figure was also revised upward by 5,000. Finally, given the preceding very weak labor data — such as initial jobless claims, layoff rates, ISM employment indices, and others — the empirical expectation was about 90,000 jobs added. Market trading volumes during the last upward wave of the euro in late June were below average and declined each day. Yesterday saw the lowest daily volume.

Even accounting for the shortened U.S. trading day, the trend is clear. That is why no significant manipulation of labor data was needed — the goal was achieved: ahead of major political events next week, the advance of anti-dollar currencies has been halted. Even at the European Central Bank conference in Sintra earlier this week, risks associated with a rapidly appreciating euro were noted.

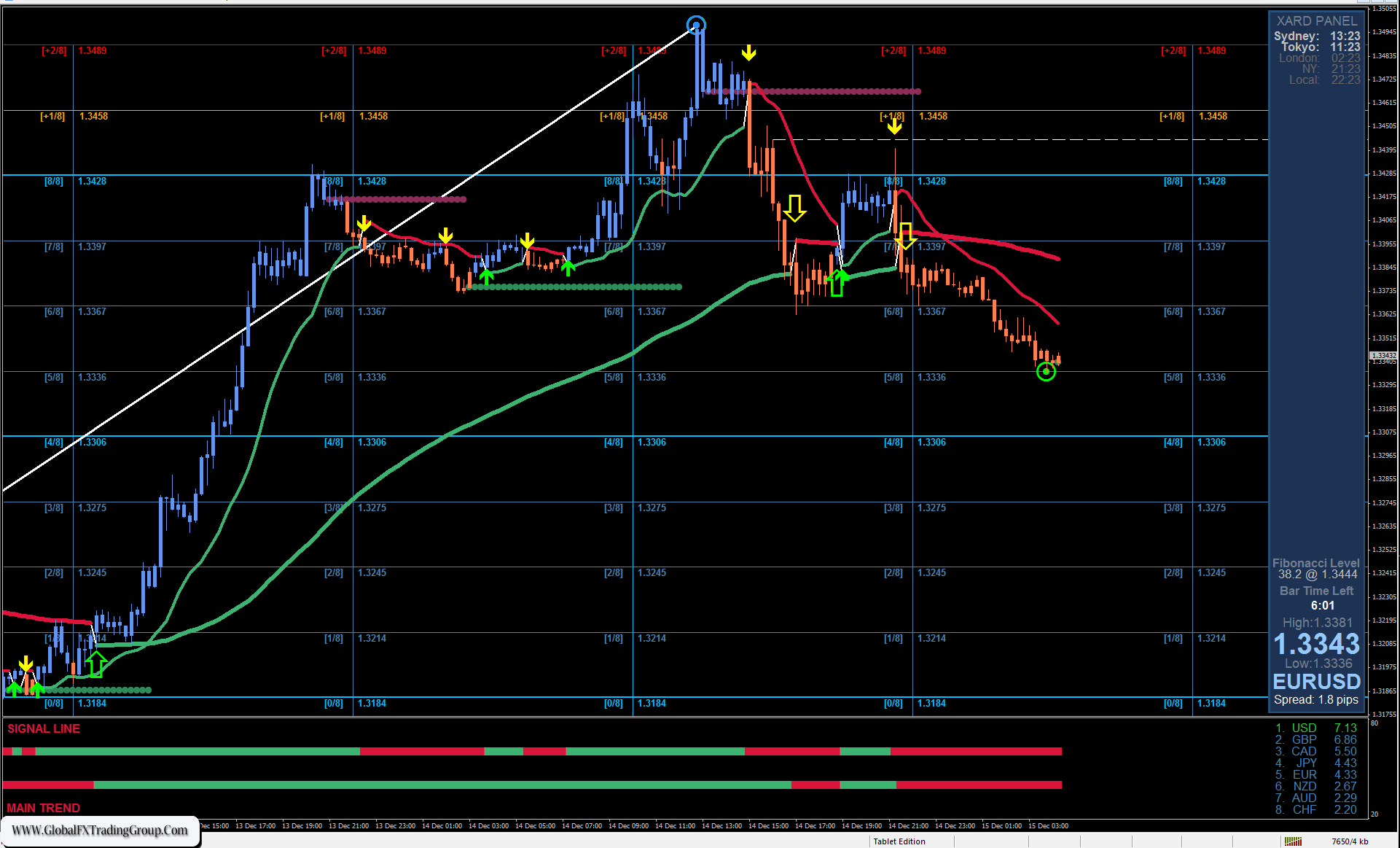

Today is a holiday in the U.S., so we do not expect strong market moves. To confirm all of the above, the price must break through the MACD line support on the daily chart around 1.1673. If this happens, the targets will open at 1.1535 and 1.1420.

On the four-hour chart, the support zone is defined as 1.1673–1.1726, formed by the MACD lines of two timeframes. We await further developments starting next week.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 28 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom