Yesterday, the euro zone’s ZEW economic sentiment indicators for April were disappointing. The index plunged from 39.8 in March to -18.5, far below the forecast of 13.2. We believe the European business community is taking a more realistic view of the trade war’s consequences than the media suggests and is also skeptical about the “off-budget” plan to ramp up defense production. We previously stated that the U.S. will likely be the trade war’s main beneficiary. As a result, we view the entire April rise in the euro as speculative and expect a decline once the right catalyst appears.

The first such catalyst could be tomorrow’s European Central Bank monetary policy meeting. We anticipate a more decisive stance from the central bank in supporting the economy and responding to slowing inflation. Today’s forecast for March CPI is 2.2% y/y versus 2.3% in February. Core CPI is expected to ease from 2.6% y/y to 2.4% y/y.

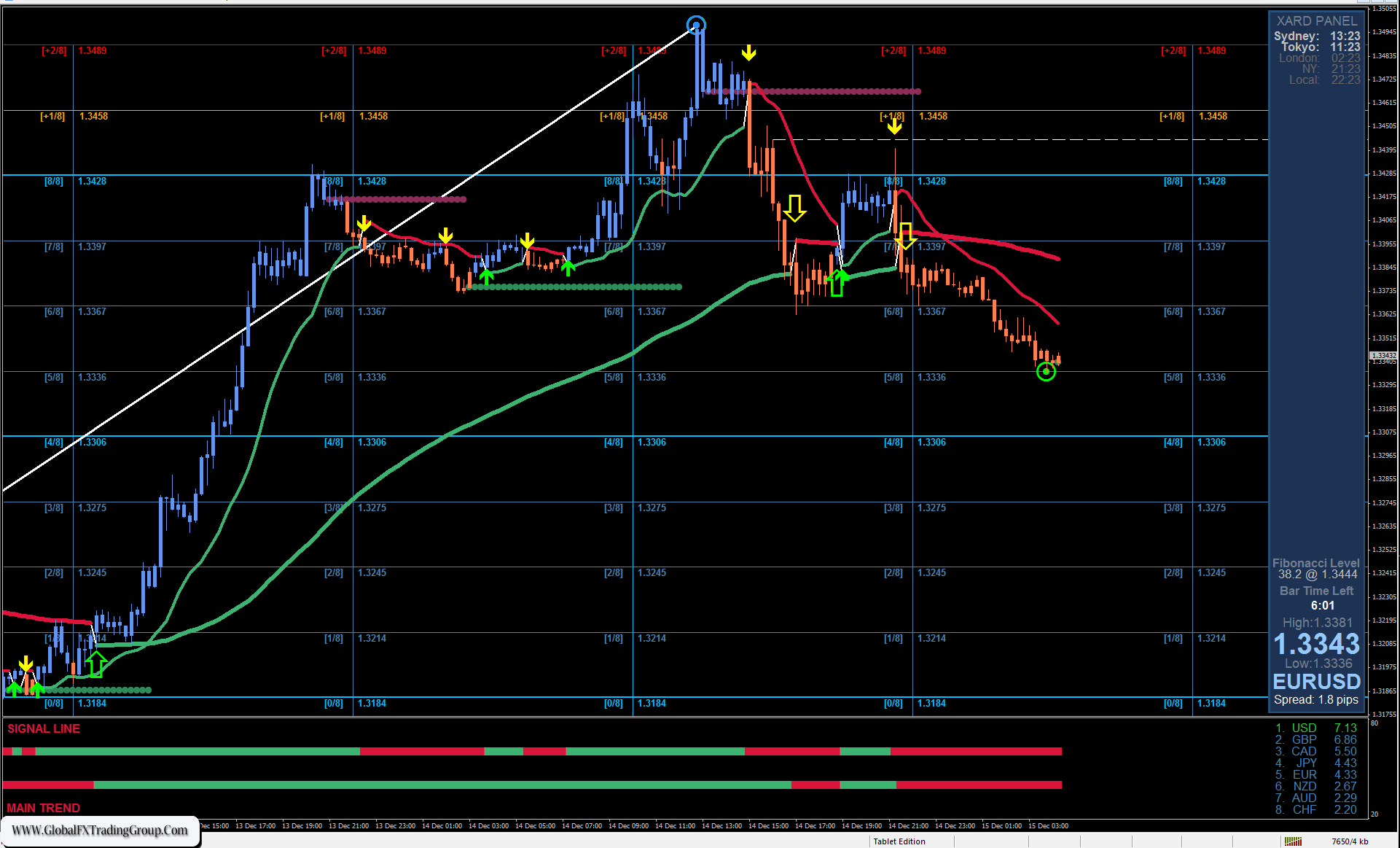

The ideal euro reversal point is the 1.1535 target. If volatility increases on the day of the ECB meeting, this level could be reached, possibly forming a bearish divergence on the daily chart. If there is no upward price spike, a move below the support range at 1.1110/50 would signal a reversal.

The price is rebounding from the 1.1276 support level on the four-hour chart. The Marlin oscillator is breaking into the positive trend territory, indicating that the upward trend is still intact. Also on this timeframe, the Kijun (MACD) line has moved into the 1.1110/50 support zone, reinforcing its importance as a potential medium-term reversal area.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 28 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom