We’ve arrived at the key event of the week—the Federal Reserve’s monetary policy decision. The interest rate is expected to remain unchanged, but we are eager to see what Jerome Powell will say about the rapidly evolving political and economic landscape. The U.S. economy is facing two major challenges: inflation and a recession.

The Fed’s perception of which issue is the bigger threat will dictate Powell’s tone. Inflation has been the dominant concern in recent years and is on the rise again, ensuring it will be a focal point. The economic slowdown has crossed a critical threshold, but the Fed tends to wait for more data before making any moves, likely indicating a “wait-and-see approach.”

The Fed has the flexibility to cut rates by 0.5% if necessary, given the current relatively high level. Ultimately, we expect the Federal Open Market Committee (FOMC) to adjust its rate projections, indicating three rate cuts by the end of the year, which may reveal what Powell might leave unsaid. Unfortunately, this does not clarify how the market will react to the Fed’s decision; it only highlights the uncertainty surrounding it and the future actions of major players.

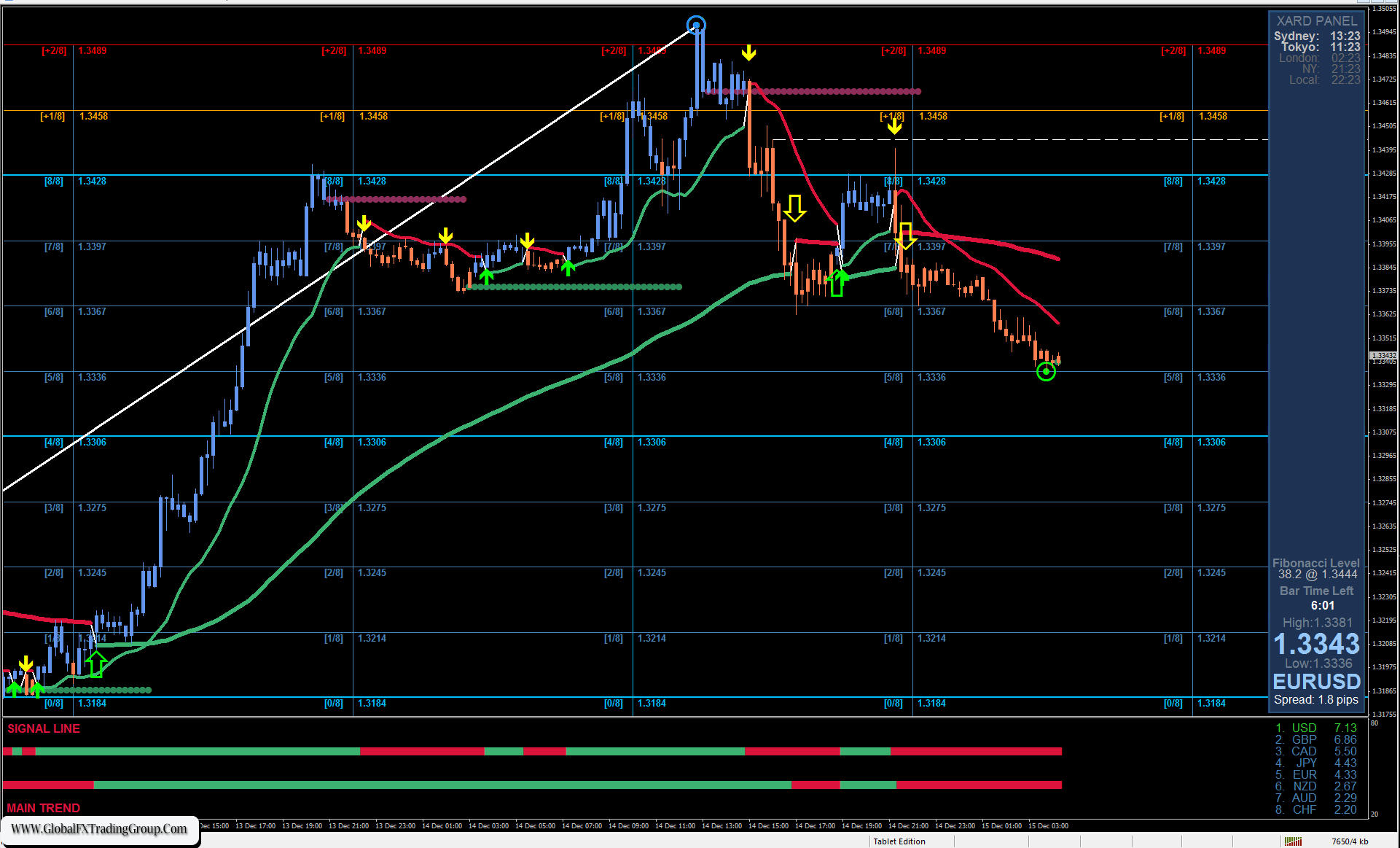

On the weekly chart, the price is testing the MACD line, signaling either a possible upward breakout or a decisive downward reversal.

On the daily chart, a divergence has formed between price and the Marlin oscillator, raising further questions rather than providing clarity. On the four-hour chart, the price appears poised, simply waiting for a signal.

Even if we had advance access to Powell’s speech, it would provide little insight into the actions of major market players. As mentioned in previous reviews, the U.S. economy seems to be more resilient in its tariff battles with Europe. We expect a medium- to long-term strengthening of the U.S. dollar, though we are uncertain whether that trend will begin today.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 28 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom