Investors’ gradual shift away from risk continues. Yesterday, the U.S. stock index S&P 500 fell by 0.30%, and the euro followed suit, losing 24 pips, albeit within the context of anticipation for the European Central Bank meeting.

The November U.S. CPI report will be released today. The Core CPI is expected to remain unchanged at 3.3% YoY, while the headline CPI may increase from 2.6% YoY to 2.7% YoY. Considering the slightly hawkish rhetoric from Federal Reserve officials over the past 1.5 weeks, the most likely scenario for the euro leading up to the ECB meeting is a decline toward the lower boundary of the 1.0461–1.0598 range.

Furthermore, the widely discussed 25-basis-point rate cut by the ECB has already been fully priced in, as evidenced by the euro’s 4.5-figure decline since November 16. The market is now entirely focused on the Fed’s actions and crisis-driven correlations.

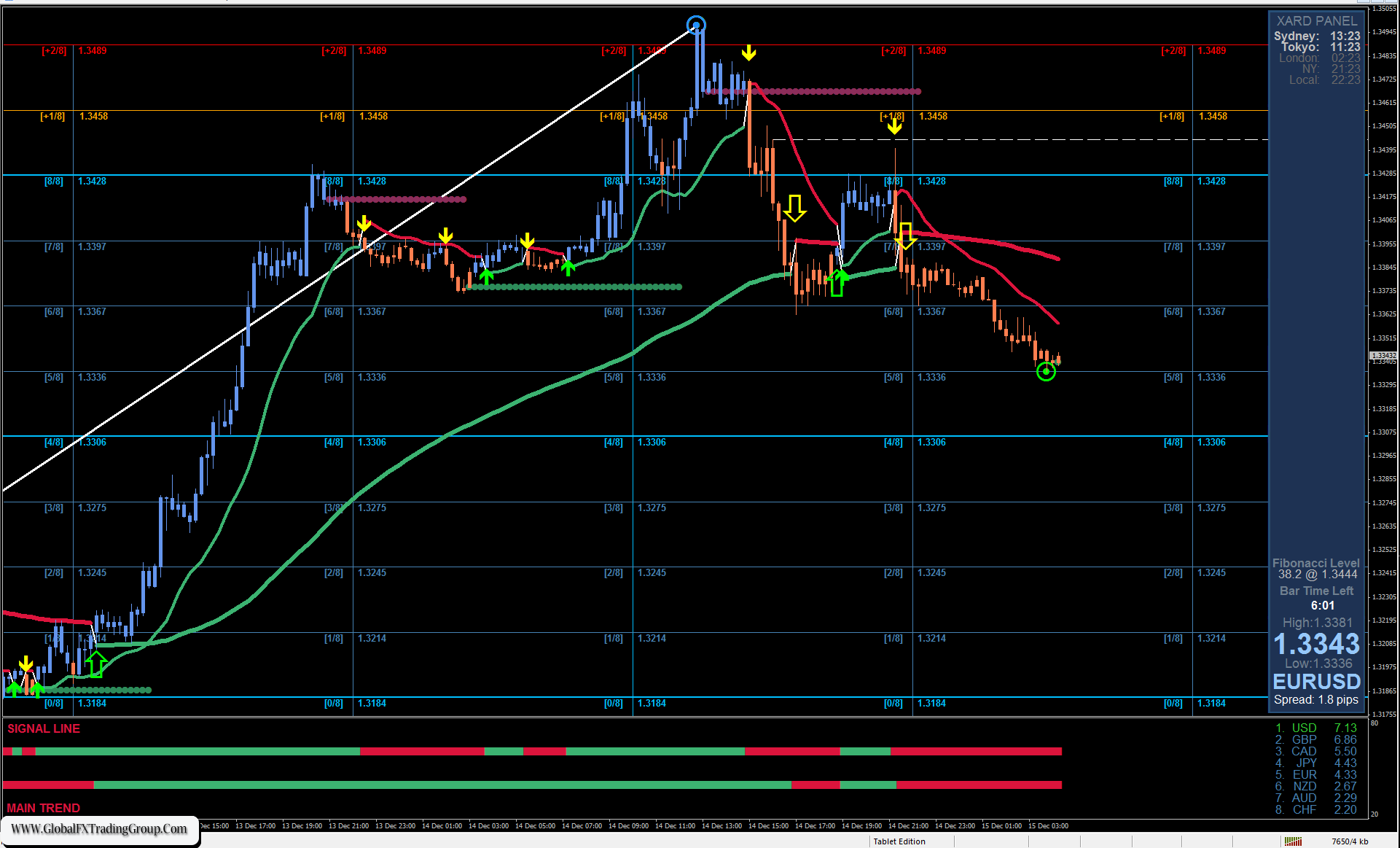

On the 4-hour chart, yesterday’s decline was halted by the MACD Line and the balance line. The Marlin oscillator remains on a downward trajectory. Today, the price may attempt to break below these indicator supports and consolidate beneath them.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 28 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom