Donald Trump has won the U.S. presidential election. The euro fell by 204 pips, while the dollar index strengthened by 1.67%. There’s nothing extraordinary about this; during Obama’s presidency, the market reacted even more energetically to his victories. Previously, we assumed that the euro would engage in a speculative rise regardless of whether Harris or Trump won. However, the outcome was the opposite—the euro fell. We now believe it would have declined even if Harris had won.

But the elections are now behind us, and they don’t influence the long-term strategy for the dollar, which points toward strengthening. The euro is on a long downward trajectory toward the 0.72–0.75 range. The next target in this long-term scenario is 1.0385, corresponding to the nearest embedded line of the red price channel and the lower boundary of the green price channel on the weekly time frame:

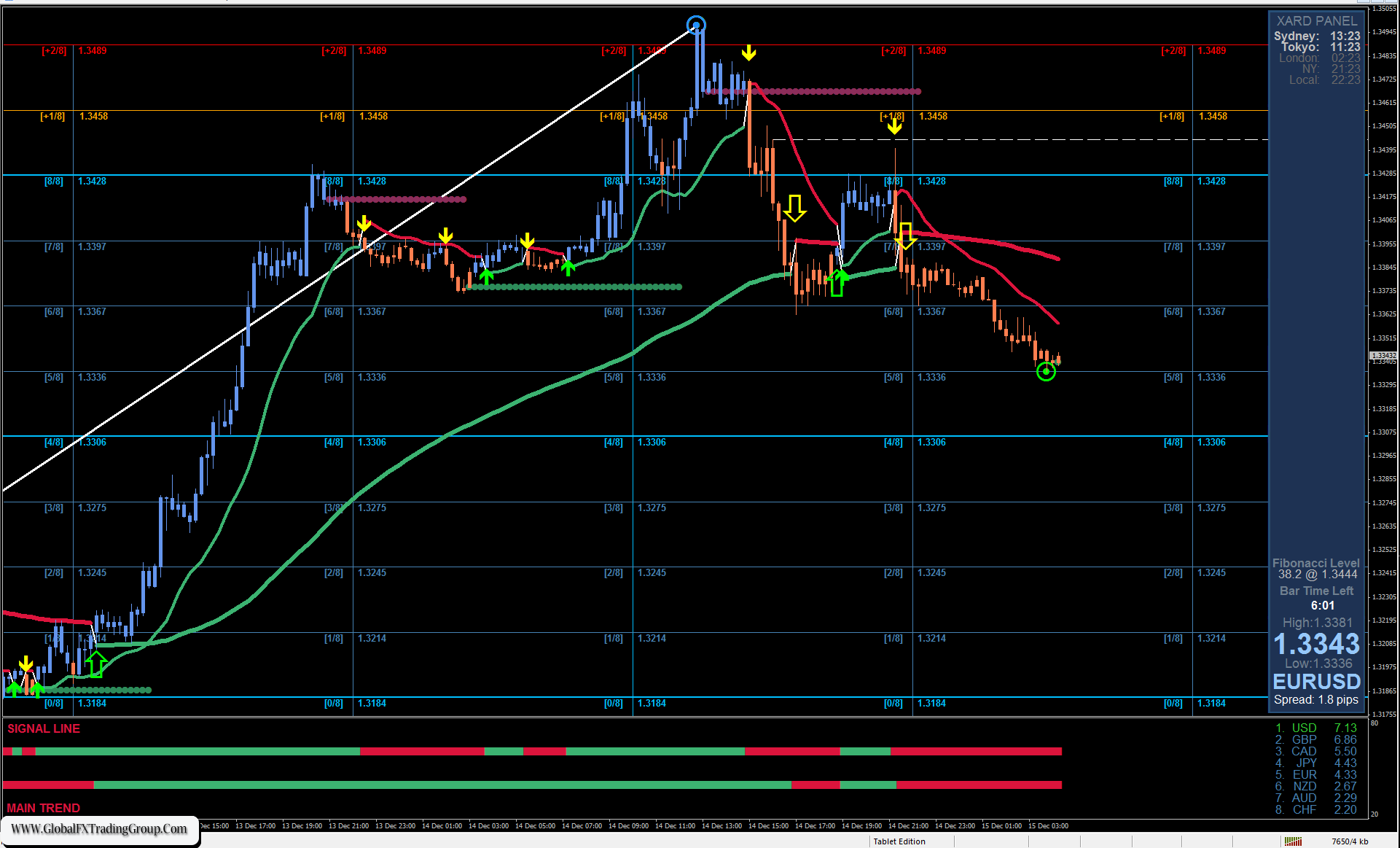

Today, the Federal Reserve is expected to cut rates by 0.25%. Markets anticipate this moderate cut, and the Fed has no reason to defy expectations. As a result, the euro’s decline will likely pause temporarily, giving the market a brief respite.

The emerging—but not yet fully formed—convergence between the price and the Marlin oscillator suggests such a breather—the 1.0777 level acts as resistance. Another equally important factor slowing the dollar’s advance is the growth of the stock market and U.S. Treasury yields. Yesterday, the yield on 5-year Treasuries rose from 4.14% to 4.27%.

On the H4 chart, the Marlin oscillator is deeply oversold. If the price stays within the 1.0724–1.0777 range for 1–3 days, Marlin will have time to recover and prepare for further declines. We are awaiting the outcome of the FOMC meeting. Speculative movements cannot be ruled out, as the stop-loss levels of euro sellers look very enticing.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 28 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom