On Tuesday, following the record high set by the S&P 500 stock index on Monday, there was a pullback of 0.76%. Oil prices dropped by 3.75%, and 5-year U.S. Treasury bonds yield decreased to 3.85%. Against this backdrop, the euro naturally fell by 15 pips, with the lower shadow testing the target support level of 1.0882.

It seems that the spectacular speculative reversal we anticipated around the European Central Bank meeting for over a week may not happen. However, at the same time, the likelihood of a stock market crash, which could pull everything else down with it, has significantly increased. The first large, obvious target for the S&P 500 appears to be at 5392, corresponding to the low of July 25, close to the September low, and coinciding with a 61.8% correction from the August 5 rally (-7.3%).

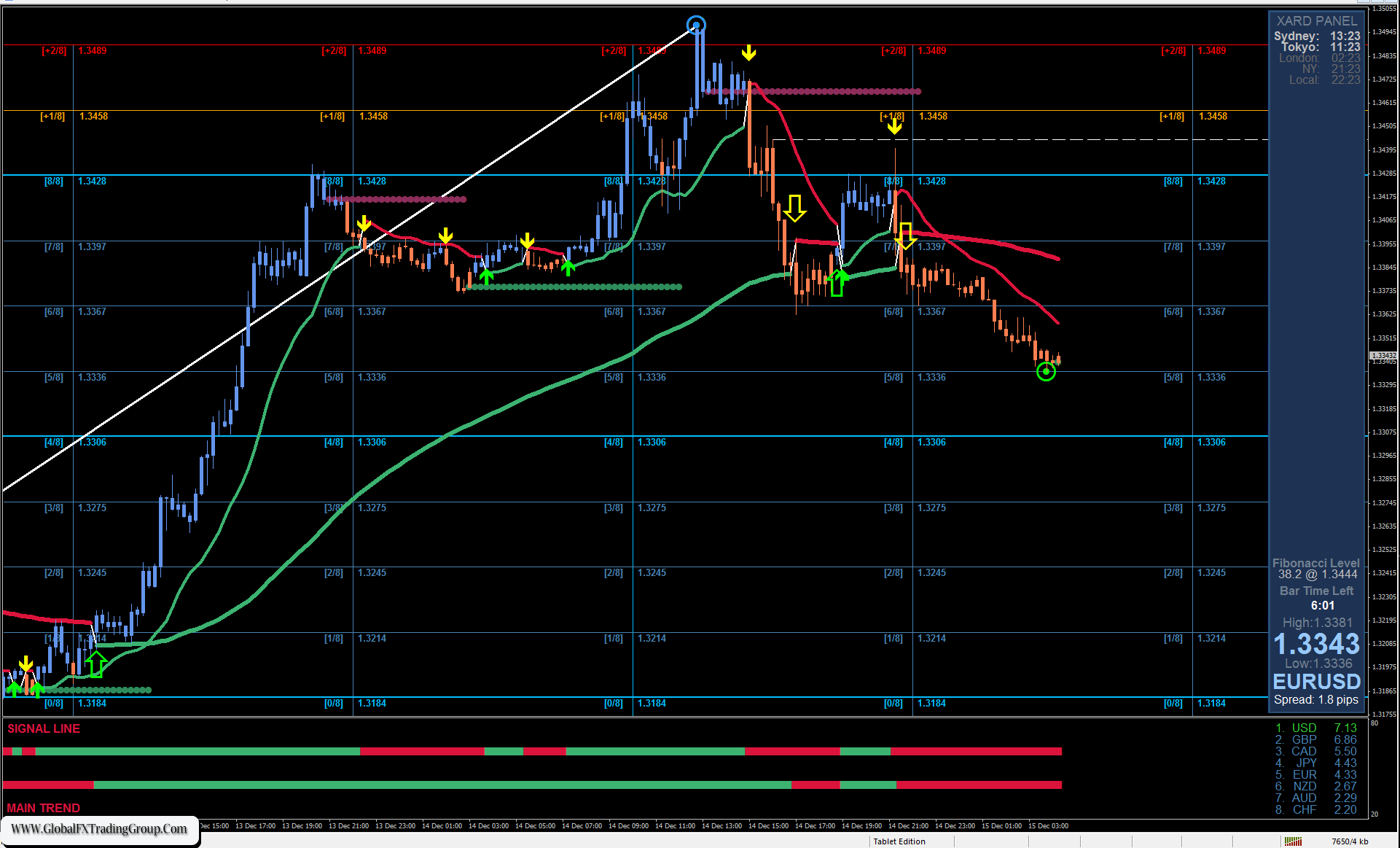

On the daily chart, if the euro consolidates below the 1.0882 level, the target of 1.0777 (the August 1 low) will open up. This plan, however, needs to be supported by tomorrow’s ECB meeting. If, as business media reports, the market has already priced in a 0.25% rate cut, there may be a slight upward correction, but after that, we expect the euro to continue falling.

On the four-hour chart, the Marlin oscillator has established a short-term downtrend in negative territory. The price is steadily declining below both indicator lines. We are still determining how strongly the ECB’s outcomes might disrupt this trend, but the market itself is only reinforcing this downward tendency day by day.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 28 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom