To say that Friday’s US employment data was excellent, strengthening the dollar and the entire stock market and setting an optimistic trend for the next 1-2 months would be an overstatement and overly optimistic. As we mentioned earlier, we agreed with the idea of a stock market rally leading up to and sometime after the US presidential election. However, we still disagree that the euro’s uptrend will break before the stock market reverses. The issue lies with the market itself.

All attempts by the dollar to independently strengthen, separate from the stock market, the strongest of which occurred from January to April of this year, have been neutralized. As a result, we now see that the euro is at the January 2023 peak (when it should have been below parity), while the S&P 500 rose by 37% during the same period. Since April 2024, the euro has been growing in tandem with the stock market, driven by risk appetite, and one-off strong economic data is unlikely to change the sentiment of major market players.

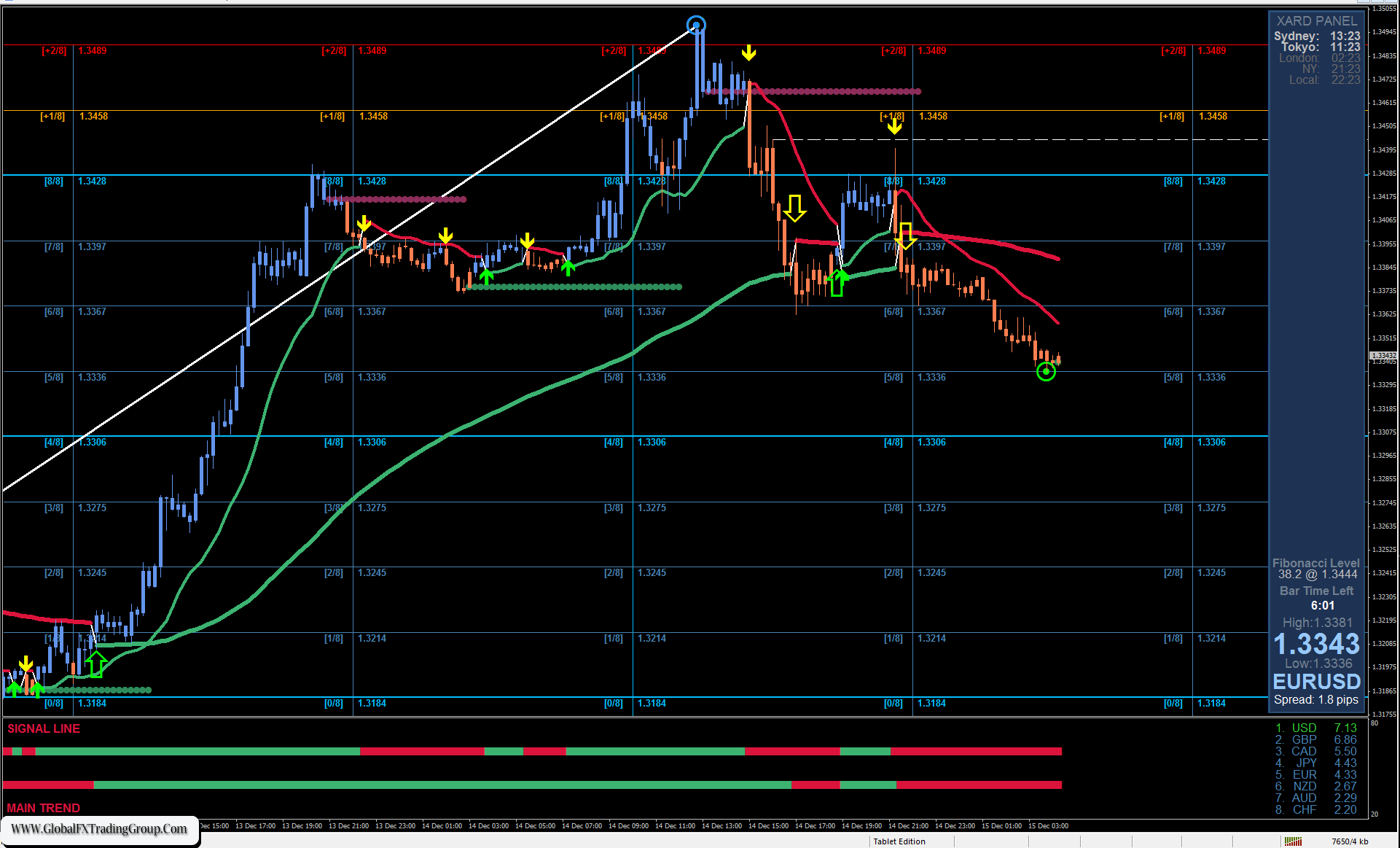

On the weekly chart, the new week has started on the 3rd Fibonacci timeline, which could signal a reversal to growth from the 110.0% Fibonacci level and a rebound of the Marlin oscillator from the zero line. If the growth continues until the 5th timeline, the target level of 1.1230, at the 200.0% reaction level, may be reached during the week of the US elections. If the reversal happens by the 6th line, the target level of 1.1350 at the 238.2% reaction level could be reached by mid-December. The price drop below the MACD line, which occurred, could be a false breakout in this scenario.

On the daily chart, the price has indicated a reversal from the target level of 1.0950 (the July 17th peak). A breakout above 1.1010 would be the first serious sign of a reversal, and a move above the MACD line beyond 1.1075 would confirm the reversal. If the price stabilizes below the support level of 1.0950, it could attempt to target 1.0882.

On the four-hour chart, the price and the Marlin oscillator are preparing for convergence. The euro needs support, as the daily MACD line and the four-hour time frame reinforce the 1.1076 level.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 28 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom