The American financial establishment decided not to “shake up” the markets prematurely. The speech by Federal Reserve Chairman Jerome Powell on Friday was surprisingly neutral, much like all his previous speeches at Jackson Hole. He only mentioned that the central bank does not plan to lower the rate by 0.5% this year.

This was also indicated by the President of the Atlanta Fed, Raphael Bostic, who spoke on the same day. The fundamental and technical factors could perfectly coincide for a reversal at the level of 1.1140, but now we have to wait for another moment. Likely, that day could be the FOMC meeting on September 18. By then, the euro might settle into the target range of 1.1280-1.1310. Since August 1 (1.0777), the euro will have moved more than 500 pips, which could correspond to an absorption of a 0.50% rate cut.

American consulting agencies consider a preemptive adjustment from the June low, which would be 630 pips. But the worst is for the euro—its decline could be very strong, especially since the European Central Bank will also lower rates in September and a week earlier. It could even be that the ECB will deliver the initial blow to its own currency.

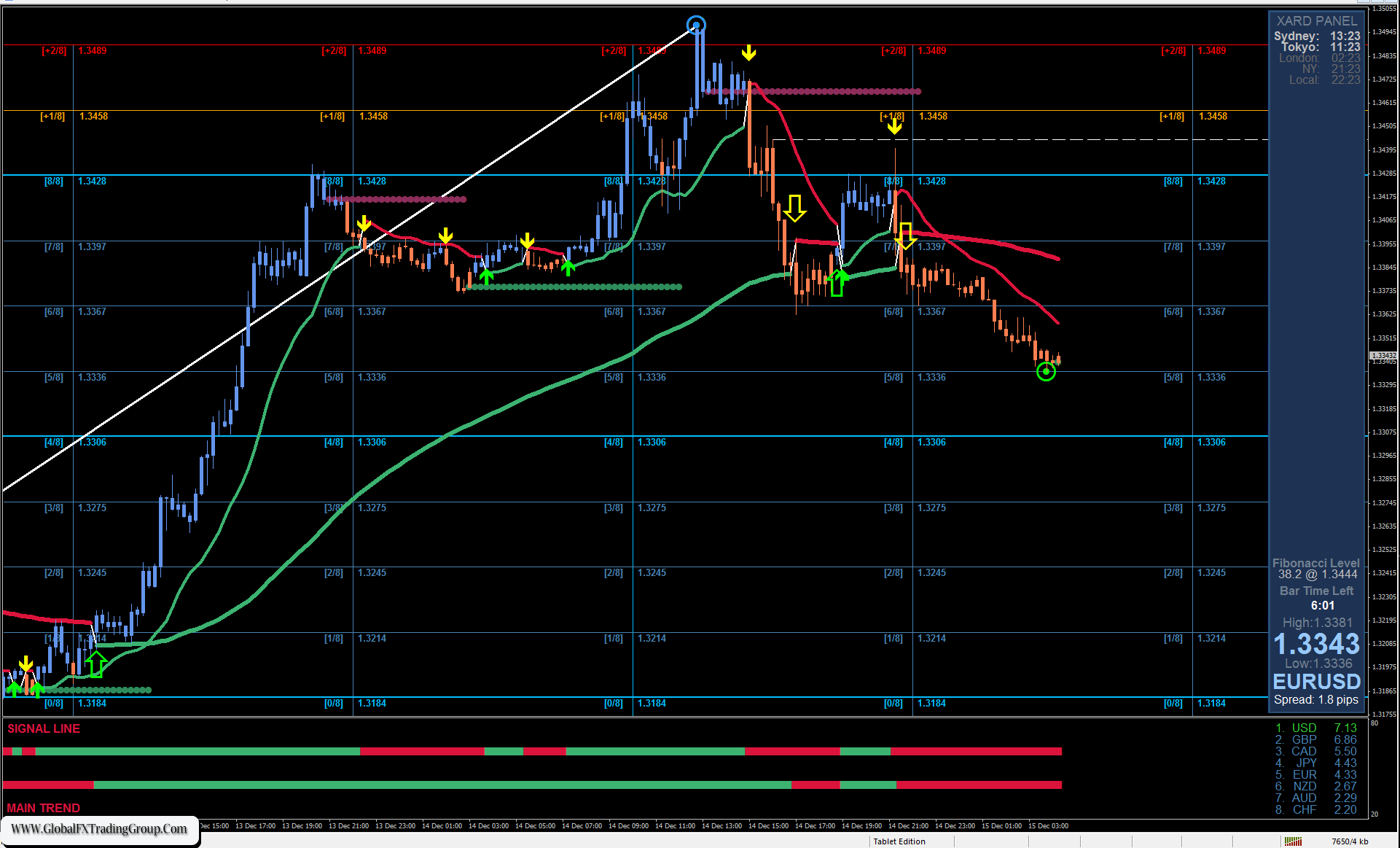

On the daily chart, the Marlin oscillator has practically stopped rising, making oscillatory movements at the lower boundary of the overbought zone. We expect the euro’s growth to slow down. A fundamental trigger for this could be today’s release of U.S. durable goods orders data for July, with a forecast of 4.0%.

A divergence is forming between the price and the oscillator on the 4-hour chart, which is also cooling the market. After this brief cooling, we expect the euro to rise to the target range of 1.1280-1.1310 (overlapping the high of July 2023).

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 28 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom