Last Friday’s U.S. employment data came in weaker than expected. The Non-Farm Payrolls shows the U.S. added 114,000 new jobs, less than the forecast of 176,000, with the June figure revised down by 29,000. The unemployment rate jumped from 4.1% to 4.3%, although this was due to an increase in the labor force participation rate from 62.6% to 62.7%. Stock and commodity markets fell, and the yen and the Canadian dollar strengthened symbolically.

But the euro surged by 118 pips. Even the British pound only gained 64 pips. It also seems odd that the euro had already gained 45 pips for the day by the time the news was announced. Friday’s trading volume for the euro was the highest of the current year. Empirically, the current business cycle, taking into account the growth of the economically active population by 0.1%, also reduces unemployment by 0.1%, i.e., unemployment is 4.2%, taking into account this index.

This is if we use the current methodology of its calculation. The quality of employment is good – the manufacturing industry created 1,000 jobs against a forecast of -1,000, although there was a decrease in this category by 9,000 in June. We are not saying that the U.S. economy is doing well right now; on the contrary, there has been a powerful move away from risk in the markets for two weeks due to deteriorating indicators.

Such solid growth of the yen (1700 pips in 17 days) was not even seen during the 2008 mortgage crisis. But only the euro is rising. According to brokers, the largest volumes were concentrated in the 1.0825/45 and 1.0855/65 ranges. We also see the latest volume spike in the range of 1.0905/20 – almost at the day’s high, which could trigger a correction on Monday. In today’s Asian session, the Nikkei 225 is down 5.34%, the S&P/ASX 200 by -2.63%, and China A50 -0.82%.

That is, the flight from risk continues. The euro’s rise may be an operation that was long prepared to knock out premature dollar buyers from the market. It was worth enduring all the preceding central bank meetings to do this.

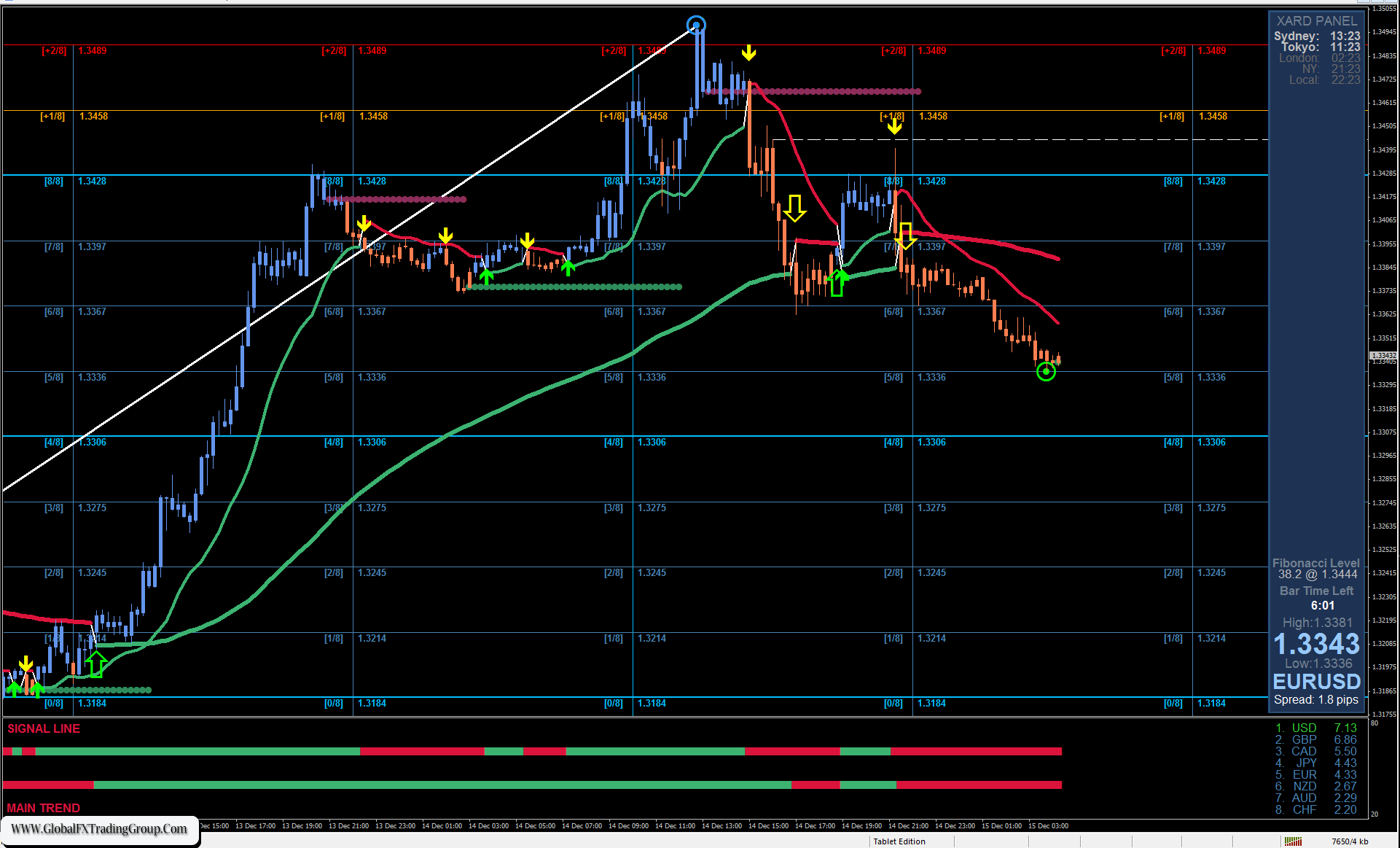

How long will the euro continue to rise after such a powerful momentum? On the weekly chart, the price has moved above the MACD line. If the price does not return below the level of 1.0905 within 1-2 days, it can continue to rise for a long time, up to the level of 1.1018 or even higher, towards a possible accumulation of higher offers.

On the daily chart, as we approach the potential resistance at 1.1018, it’s crucial to keep an eye on the 1.0905 level. A reversal is also possible from the target resistance at 1.0990. A consolidation of the price (daily) below 1.0905 will be the first sign of the end of the rise.

On the 4-hour chart, nothing is holding back the price from rising. The Marlin oscillator lies in a flat range, a standard view before further growth. We await further developments.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 28 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom