Our assumption yesterday about the Federal Reserve’s focus on changing the forecast for the number of rate cuts by the end of the year was confirmed. At the press conference, Fed Chair Jerome Powell indicated that the central bank is paying close attention to the labor market, and the rate may not be lowered by the year’s end. The Fed’s dual mandate is emphasized during periods when current conditions should be maintained. However, the market reacted very weakly to these signals.

It’s possible that investors were more concerned about winding down carry trades with the yen, as earlier in the morning, the Bank of Japan raised its rate from 0.10% to 0.25% and announced a gradual reduction of its bond purchases on its balance sheet. If we see the Fed’s reluctance to lower rates and the exit from carry trades, there should be a capital flow into dollars.

The difficulty lies in the fact that investors are once again investing in equities (S&P 500 up 1.58%), commodities (oil up 5.10%), and gold (up 1.58%). Tomorrow, U.S. employment data for July will be released. The forecast for new jobs in the non-farm sector is 177,000, down from June’s 206,000. The optimistic forecast means the Fed has a reason to cool down investor enthusiasm.

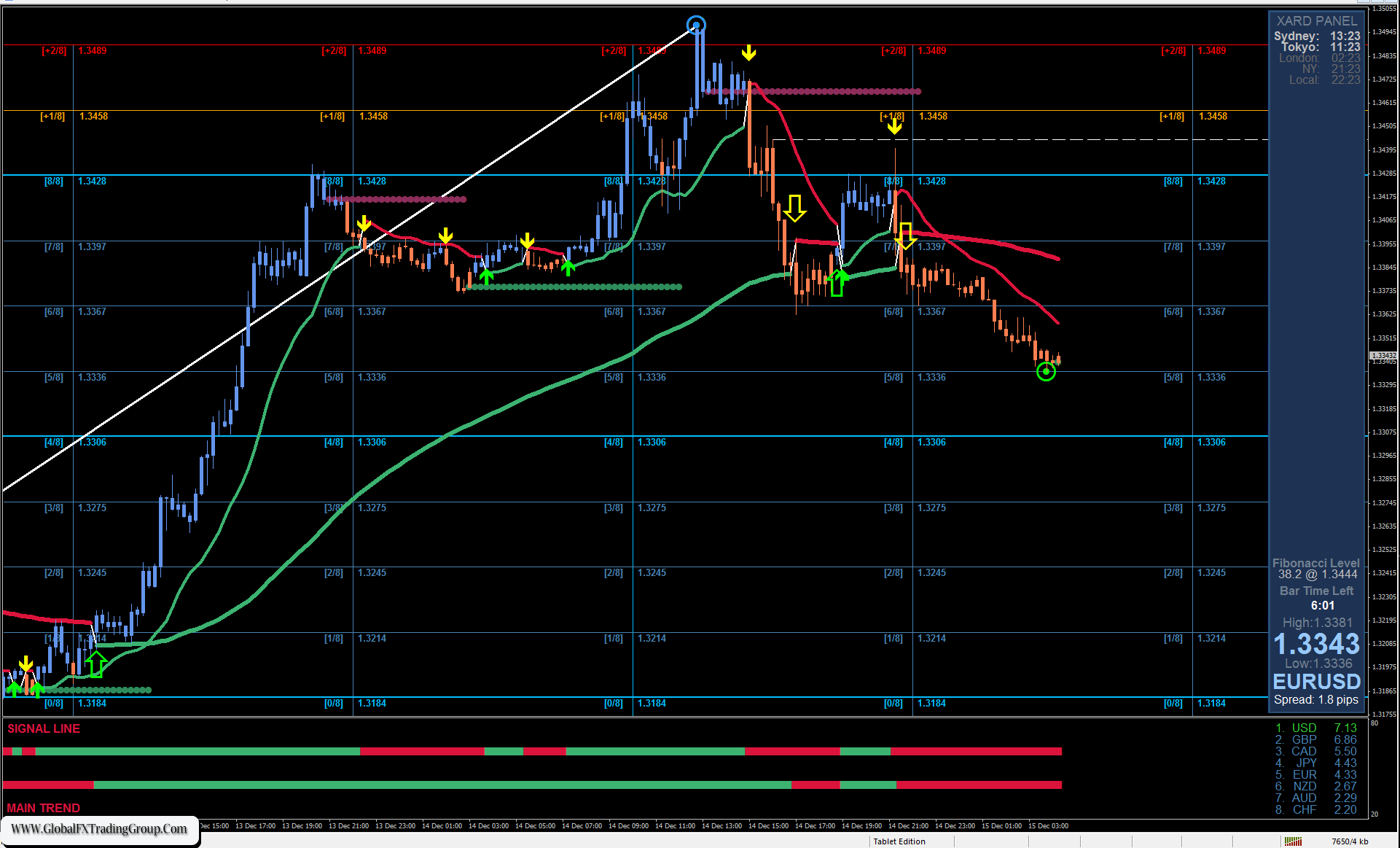

On the daily chart, the price has moved upwards from the support of the balance line, which indicates short-term interest in buying. The Marlin oscillator is considering crossing into bullish territory. The pair may continue to rise until tomorrow’s non-farm payrolls data is released.

On the 4-hour chart, the price’s convergence with the oscillator has proven effective. Marlin is already rising in positive territory, and the price is attempting to climb above the balance line. Above the balance line, there is resistance from the MACD line at 1.0850, which coincides with yesterday’s peak. The convergence effect may dissipate here. Consequently, the price will likely move sideways until tomorrow evening (gray rectangle).

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 28 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom