Ahead of the Federal Reserve’s rate decision on July 31, the euro has decided to drift within the range of 1.0788-1.0905. This indicates market instability, which is most likely to continue the movement of the previous days, i.e., downward, in an attempt to overcome 1.0788.

As can be seen, even the signal line of the daily Marlin oscillator has turned into a correction without reaching the zero line, not from a support level. As a result, we do not anticipate any significant growth. The pair is expected to move sideways today and tomorrow.

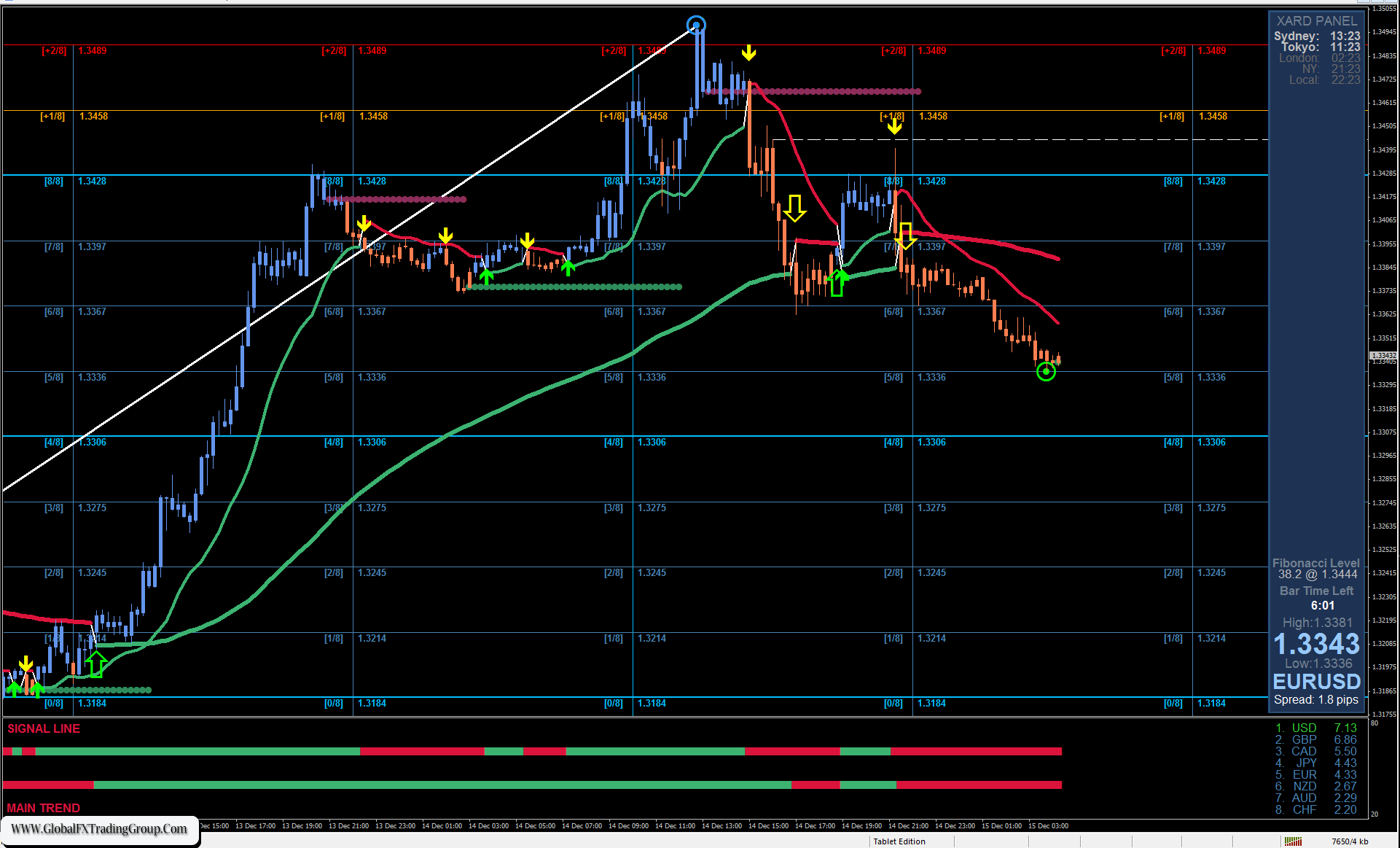

On the 4-hour chart, the price has paused at the balance line. While a ‘mild’ corrective scenario is possible, the price is unlikely to challenge the MACD line. The Marlin oscillator’s upward move could be a false signal, as is often the case with the oscillator’s increase. In this uncertain market, the best strategy is to continue observing.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 28 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom