In anticipation of today’s ECB meeting, the euro has covered the entire range of target levels, nearly 120 points (1.0788-1.0905), with final consolidation near the upper level of this range. Yesterday, the euro closed with a 10-point decline, but since the S&P 500 rose by 1.18%, the European currency is starting to rise this morning.

The ECB is expected to cut the rate by 0.25%. Although this cut is anticipated, it is not priced in by the markets. Consequently, we expect a price drop with an attempt to break through the significant support at 1.0788. Consolidating below this level will mark the beginning of a new medium-term downtrend.

However, technical details allow for a significant rise in the euro before it falls. The simplest scenario is reaching the target level of 1.0964, gradually increasing the divergence with the Marlin oscillator. The price might rise even higher to the target range of 1.1001/10 (the peaks of November and December last year).

By this time, the S&P 500 index, which has so far prevented the euro from falling, will reach a new historical high around 5382 at the boundary of the rising price channel and will also form technical divergence.

These technical details could have been highlighted during Christine Lagarde’s press conference, during which she acknowledged the strength of inflation and indicated a longer-than-expected period before the second rate cut.

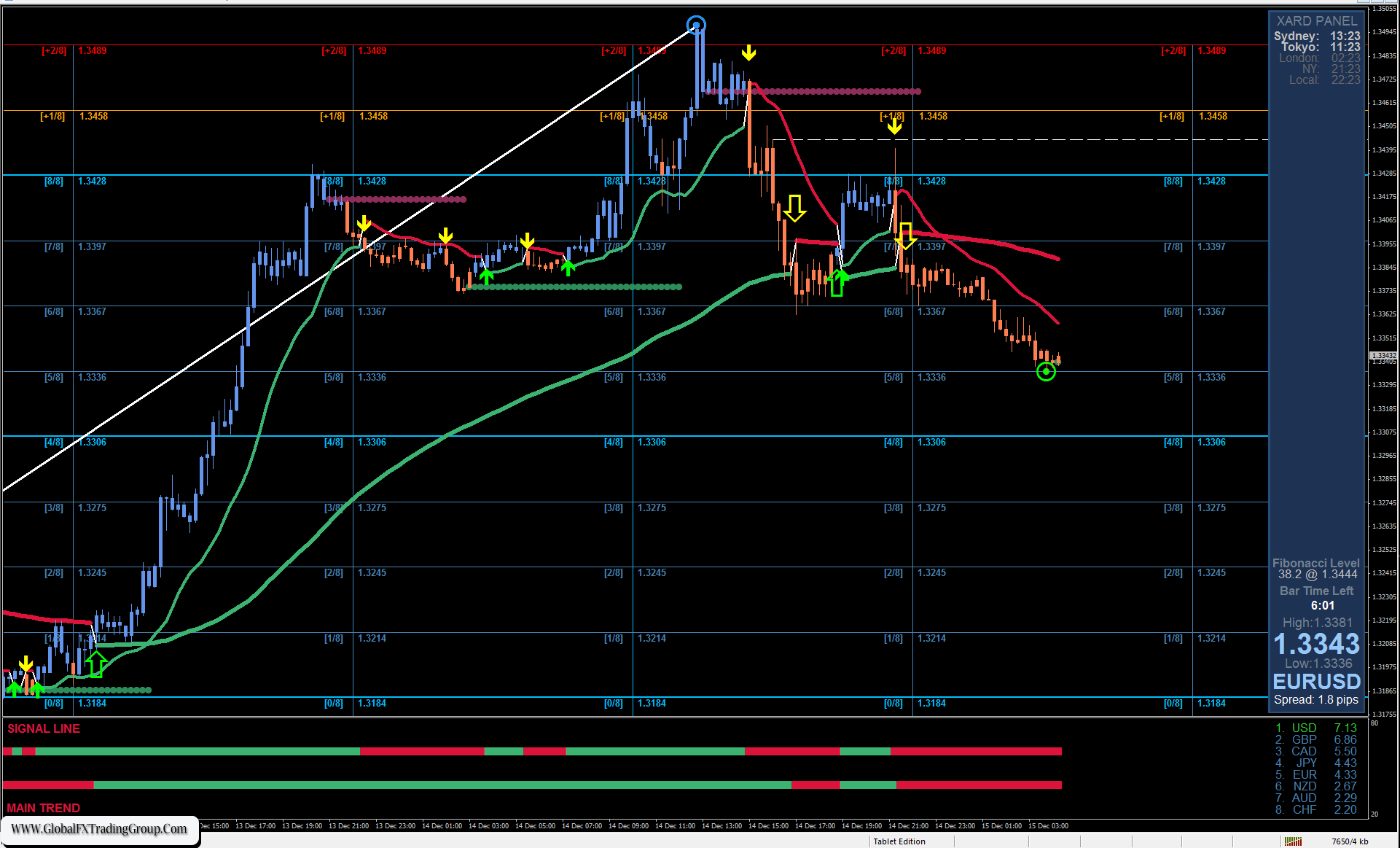

The price found support yesterday from the MACD indicator line on the four-hour chart. The Marlin oscillator briefly dipped below the zero line but has returned to positive territory. We see the traditional false downward movement. Consolidating the price below the MACD line, below the 1.0858 mark, will shift the technical indicators towards a decline. We now await the ECB release and subsequent comments from Christine Lagarde.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 28 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom