On Friday, the euro closed the day almost unchanged, as the price settled below the level of 1.0905 and below the MACD line on the daily time frame. The signal line of the Marlin oscillator is falling and does not help the price with its attempt to return above these important lines. On Wednesday, the FOMC will shed light on the Federal Reserve’s monetary policy outlook, and then investors will be able to show how determined they are.

In our previous reviews, we mentioned that even if the Fed verbally significantly softens its stance, i.e., unequivocally declares a rate cut in May, the euro may show an “unnatural” decline, albeit not without a decline in the stock market. The point is that with the European Central Bank rate at 4.50%, the yield on German 5-year bonds is at 2.46%, while with the Fed rate at 5.50%, the yield on 5-year US bonds is at 4.33%. The difference is quite significant. With verbal easing from the FOMC, yields on US bonds could plummet, leading to a market and even “fair” growth of the dollar.

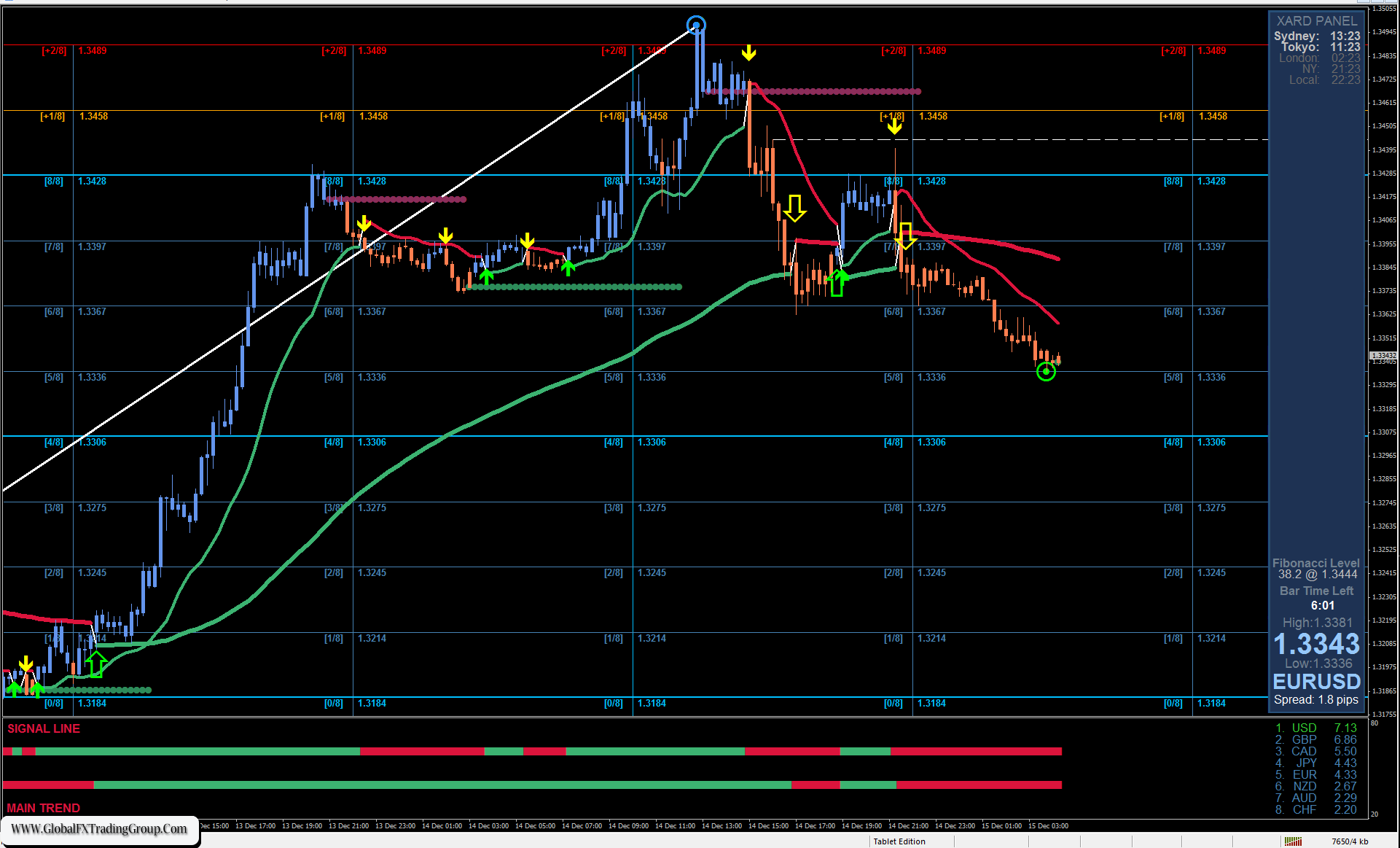

On the 4-hour chart, the price is starting to consolidate below the level of 1.0905. The Marlin oscillator, which is taking a break, is correcting in the downward territory so it can have the opportunity, under favorable conditions, to sharply resume the decline into the oversold zone. So, our main plan is to aim for 1.0796, then 1.0724. In order to resume growth, the price must settle above 1.0905 and we can wait for the Fed’s decision on monetary policy there. The target is the range of 1.1001/10.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom