The euro is gradually approaching the Fibonacci corrective target of 1.0971. However, the target is temporary since the price has to deal with a more important task of testing the highs of November-January at 1.1001/10.

At first glance, the plan seems normal, and there are no major risks. However, the Federal Reserve meeting will take place next week, and the price will not be in a neutral position in the range, but in a clearly defined upward trend, which is extremely rare during such periods. Therefore, it would be more suitable to encounter the 1.0971 level during such an event, where the Marlin oscillator can form a narrow range.

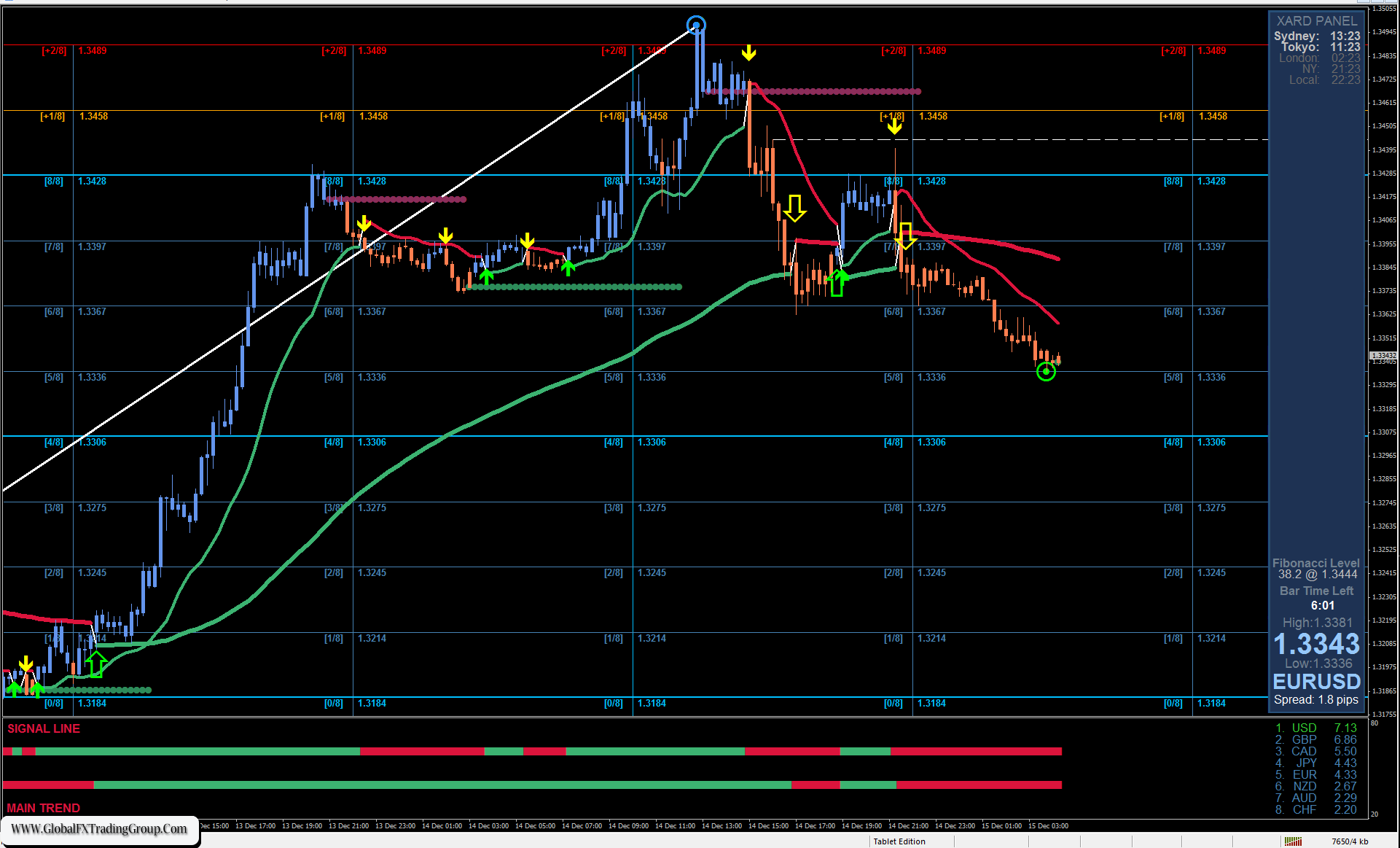

On the 4-hour chart, the price is rising above the balance and MACD indicator lines. The Marlin oscillator seems to be getting ready to stretch along the neutral zero line. Therefore, we expect the price to move sideways in the range of 1.0921/71, with the MACD line acting as the lower boundary.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom