The euro developed a bearish momentum on Tuesday, contrary to our expectations. The final assessments of business activity for December in major regions showed mixed, overall weak data, which led to a decline in stock markets and some risk aversion. However, as we mentioned earlier, we are not changing our main bullish forecast yet. Today, the US will release PMI data from the ISM institute, and here, we could see optimistic data.

The reason is that from November to mid-December, the US Treasury raised $298 billion in net debt (taking repayments into account), part of which traditionally goes to the Chicago industrial sector, which should have a positive effect. Industrial orders in the US in November are expected to rise by 2.3%, but the data will only be released on Friday and may be overshadowed by employment data. Unemployment is expected to rise from 3.7% to 3.8%.

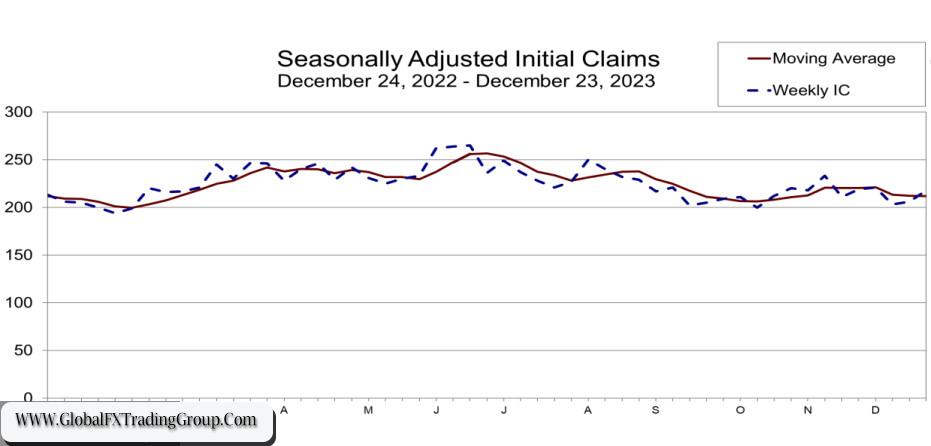

Nevertheless, we remain optimistic, as initial claims for unemployment benefits, considering seasonal fluctuations, are slowly but steadily decreasing.

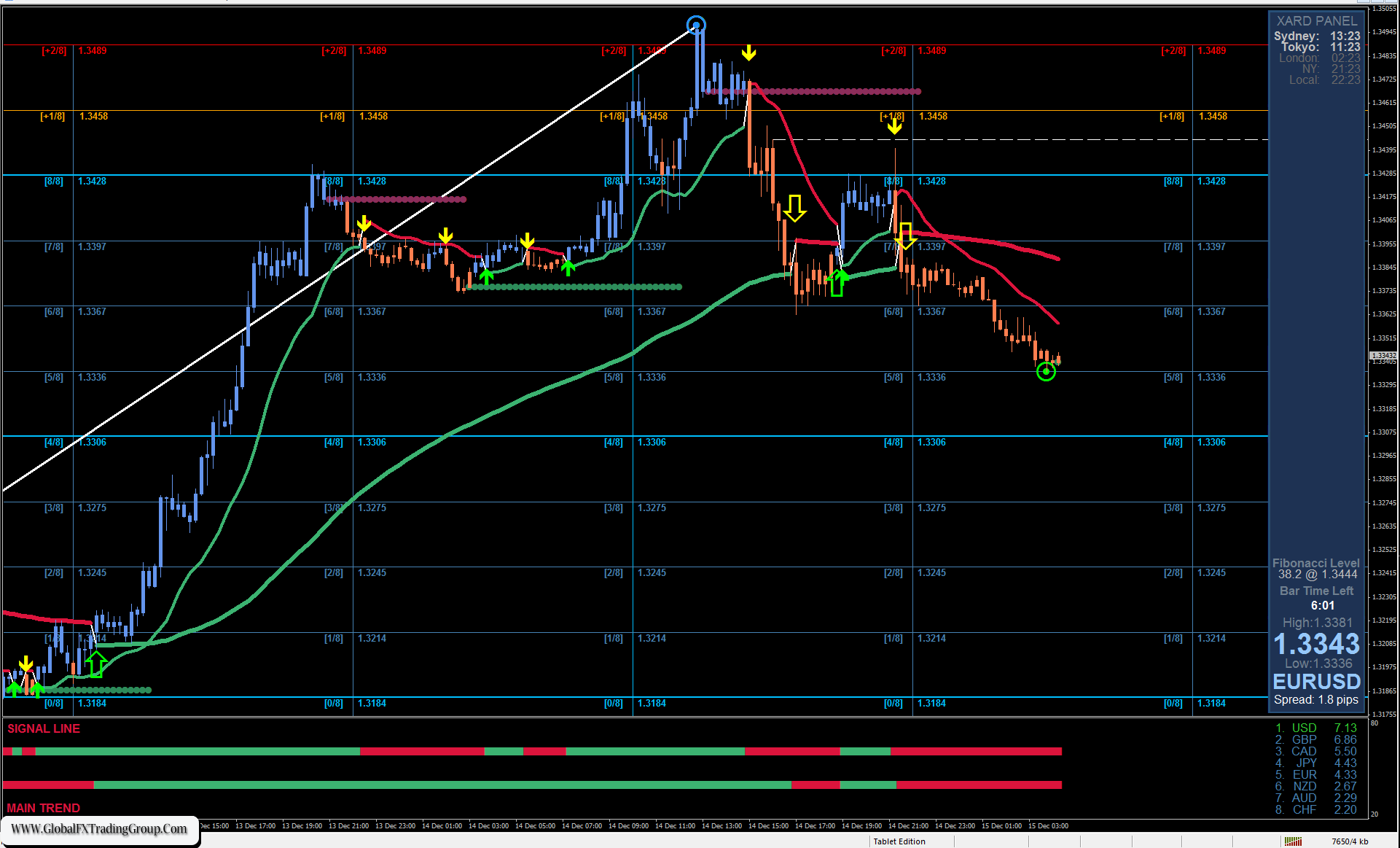

In general, increased volatility and market nervousness may persist until the end of the week. Yesterday, the balance indicator line stopped the euro from falling, meaning that this movement was within the bounds of a correction. Even visually, a test of support at 1.0905 will not violate this balance line, which will have time to react.

However, if the price consolidates below 1.0905, it will signal further decline to 1.0825 or even lower, down to the MACD line (1.0790). In this regard, one cannot ignore the consolidation of the Marlin oscillator in negative territory. On the 4-hour chart, the price is fully in a downward position, as its progress occurs below both indicator lines and Marlin is in a downtrend territory.

Here, we can see that only a price move above the resistance at 1.1033 will be a condition for further growth toward the previously mentioned targets (1.1185 and above) because the level of 1.1033 is reinforced by the MACD line, which has become very important. We are waiting for further developments.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom