Following the outcome of yesterday’s Federal Reserve meeting, investors learned that FOMC members expect a triple rate cut in the coming year. The US Dollar Index fell by 0.85%, the S&P 500 rose by 1.37%, and the yield on 5-year US government bonds dropped from 4.23% to 3.98%. The euro rose by 80 pips by the end of the day, approaching the target level of 1.0905.

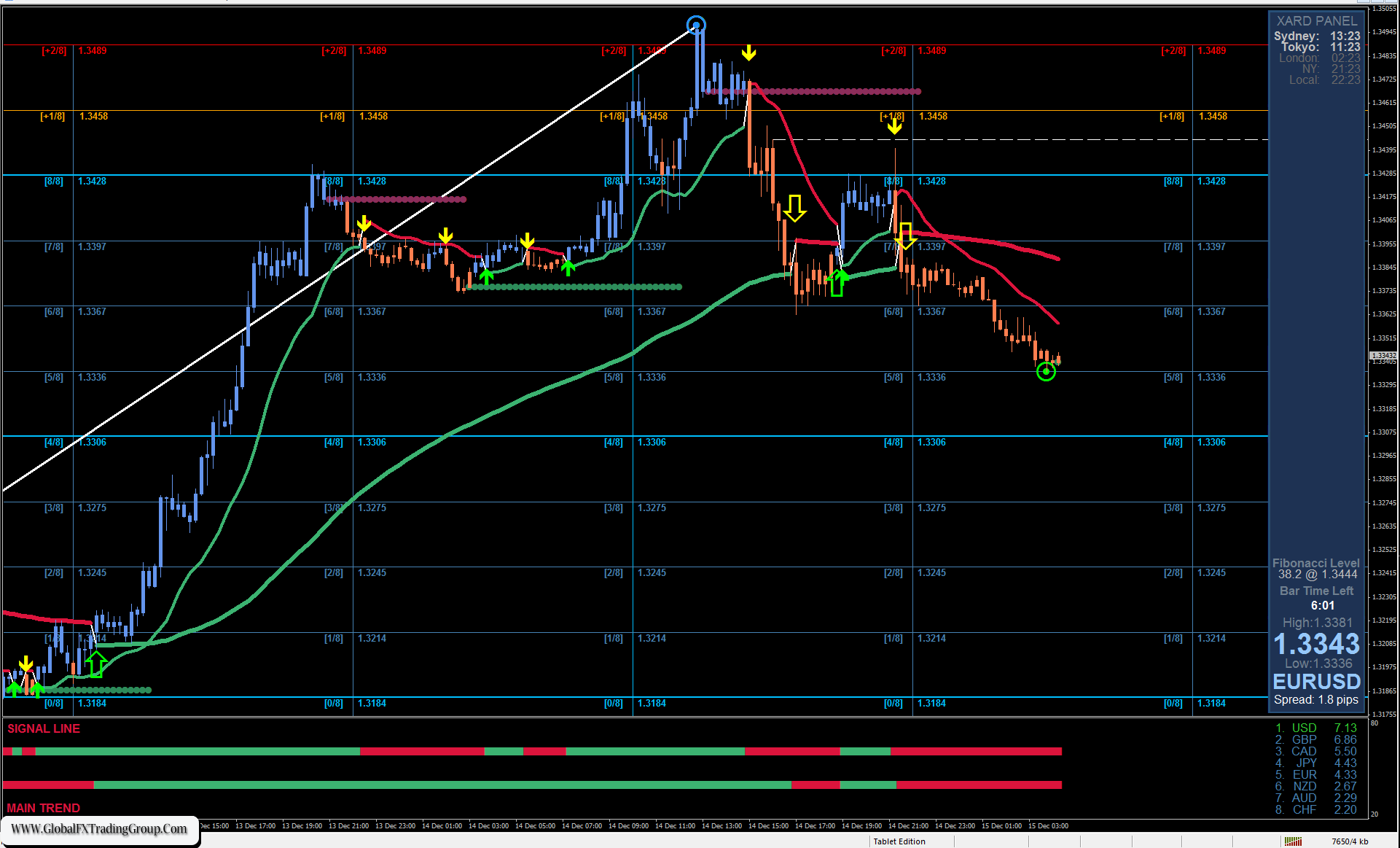

On the daily chart, the signal line of the Marlin oscillator also came very close to the border of the uptrend territory. Ahead of the European Central Bank meeting, we believe that the euro will experience a small consolidation before resistance, and then it will continue to rise since the ECB has more reasons to maintain a slightly tighter rhetoric. The target for the next few days is 1.1076 – the peak on April 14.

On the 4-hour chart, the price has forcefully passed through the nearest indicator and graphical resistances, settled above them, and is now preparing to overcome the next target levels. Considering the sharp rise in the Marlin oscillator, a correction is possible before the ECB meeting.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom