Yesterday, the euro fell by 85 pips after the European Central Bank’s decision to raise interest rates by 0.25%. However, this decline was baffling for the following reasons: while the rate hike was not unexpected, it was not factored into the euro’s current exchange rates, which has been declining by 6 figures since mid-July.

Other currencies (Canadian and Australian dollars), gold, oil, and stock markets all rose, U.S. bond yields also increased, and the likelihood of interest rate hikes staying unchanged for the Federal Reserve’s September meeting remains at 98%. Yesterday, U.S. retail sales data for August showed a 0.6% increase, and producer prices for the same month increased by 0.7% (1.6% YoY compared to 0.8% YoY previously), but this data came out after the euro had already started to fall.

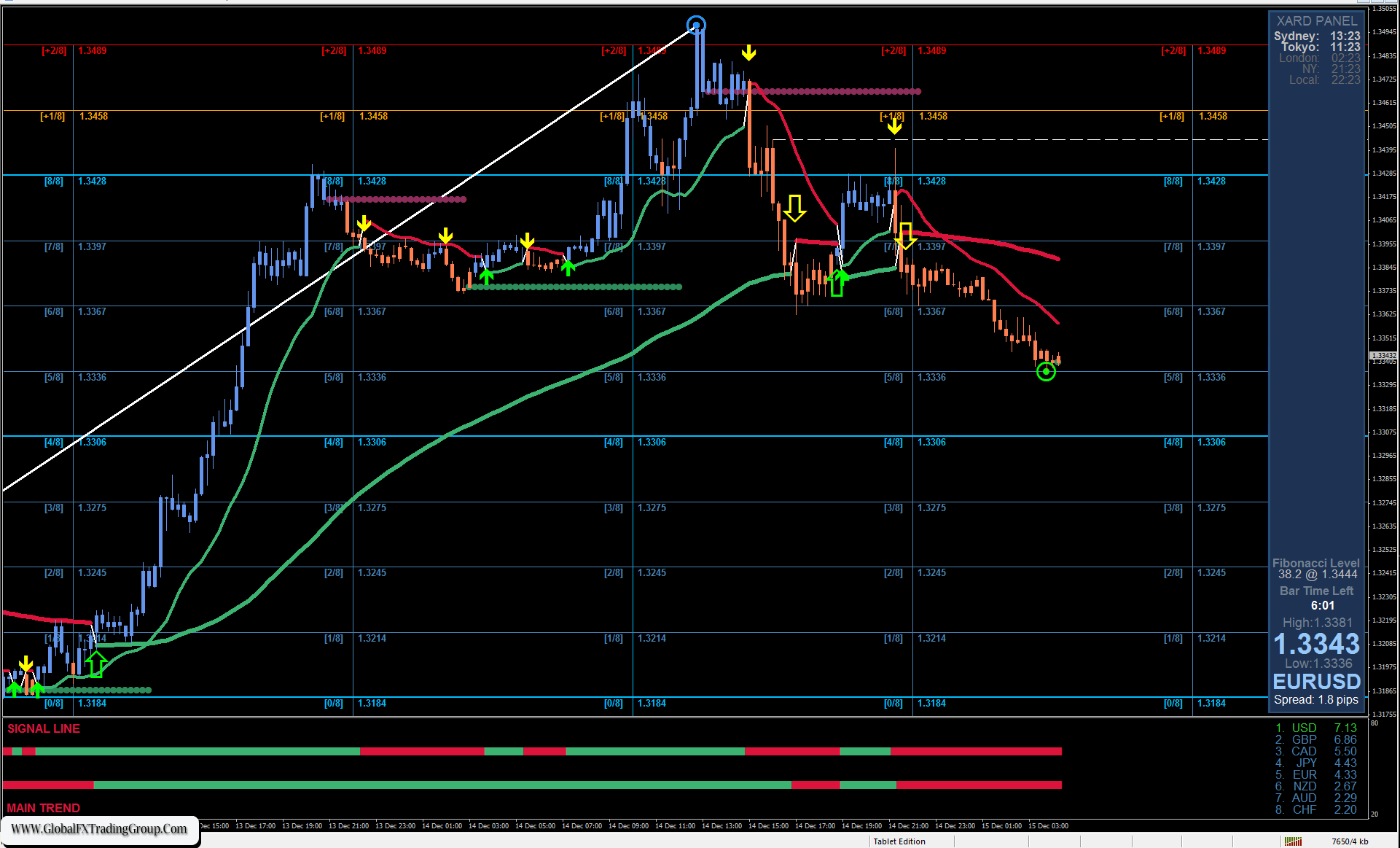

Paradoxically, the technical picture with the potential for a reversal has become clearer – a double convergence has formed on the daily chart. Also, the price reached the May 31 low, and on that day, the euro reversed and started a one-and-a-half-month uptrend. Yesterday’s trading volume was significant, but if it is related to closing positions, then it wouldn’t be difficult to reverse the trend.

However, the downtrend persists. If it continues, and the price breaks below the nearest support at 1.0613, the target will be 1.0552, and from there, the price can even reach a strong support area consisting of Fibonacci levels, the price channel line, and the target level at 1.0483. The convergence will likely be broken.

It is possible that the price will not show its succeeding direction until the Fed holds its meeting next week. If the market ignored the U.S. CPI and the ECB interest rate hike, strategic investors are likely waiting for the Fed meeting.

On the 4-hour chart, the price is falling below the balance and MACD indicator lines, and the Marlin oscillator is decreasing in the bearish territory. The pair has a bearish bias, and it could reach the target of 1.0613.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services, o individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom